Bill Ackman Strategy: 8 investment principles

Among the famous traders still in business Bill Ackman is certainly one of the most popular. He managed to demonstrate how audacity and stubbornness bring great results in trading, with dizzying economic returns.

The performance of its hedge fund, Pershing Square Holdings has been a benchmark for investors and traders around the world for years.

The fund’s performance hasn’t always been excellent, but it has often hit incredible numbers for such a large hedge fund, like 40% in 2014 and 58.1 in 2019.

In this guide we will review the life, investments and strategies used by this successful trader, trying to derive the most important lessons.

We will show you how you can improve your trading results, how to train and how to practice, taking advantage of the free Demo accounts offered by eToro and other online brokers on the market:

|

Platform: etoro Min. Deposit: 50€ License: Cysec |

|

|

|---|---|---|---|

|

Platform: xtb Min. Deposit: 100€ License: Cysec |

|

|

|

Platform: iqoption Min. Deposit: 50€ License: Cysec |

|

|

|

Platform: ubrokers Min. Deposit: 250€ License: Cysec |

|

|

|

Platform: trade Min. Deposit: 100€ License: Cysec |

|

72.30% of retail CFD accounts lose money

|

|

Platform: forextb Min. Deposit: 250€ License: Cysec |

|

|

Index

Bill Ackman, little history

Bill Ackman was born on 11 May 1966 in Chappaqua, in the state of New York, to parents of Jewish origin. Bill’s father, Lawrence David Ackman, was president of a New York financial firm. This probably affected the childhood and adolescence of the young Ackman.

Bill graduated from Harvard with a degree in Social Studies and also obtained a Masters degree from the same university.

He married in 1994 with Karen Ann Herskovitz, with whom he will have three children. The couple separated in 2016 and three years later, Bill remarries. Ackman’s new wife is named Neri Oxman, with whom he will have another child.

Immediately upon graduation, this brilliant young man founded his first finance company: Gotham Partners, along with a Harvard colleague.

From that moment on, Bill never stopped and his career as an investor took off, transforming him into one of the famous traders of the new millennium.

Where does Bill Ackman invest?

Bill Ackman goes in search of anomalies and peculiarities that can affect the market. When he finds them he is not afraid to invest, both upwards and downwards, following his principles, which we will talk about in a specific paragraph.

For example, he had already understood in 2002 that the American real estate market was based on mortgages granted too lightly and that it would soon collapse.

Despite Standard & Poor’s triple A on MBIA bonds, linked to the real estate sector, Ackman made a colossal short sale on these bonds, which as we all know collapsed in 2008.

In his career, Bill Ackman has never had a problem carrying his ideas forward, despite everyone’s skepticism and this has led him to success.

His short sales have not always gone the right way. One of Ackman’s biggest flops is having bet down on Herbalife for $ 1 billion. The stock did not collapse but rather the opposite, causing him a big loss.

His way of investing is bold, overbearing and counterintuitive, it is not easy to understand but in this guide we will try to learn something from this fabulous trader.

Bill Ackman teachings

Bill Ackman teaches us that you have to be convinced of your strategy and follow it even if no one else believes it.

His principles are fundamental and Ackman follows them as if they were commandments and makes them memorize even to his collaborators.

This famous trader is not afraid of either aiming high or selling short if all the conditions are met.

However, remember that short selling is a rather complex and definitely risky trading strategy, so before putting it into practice we recommend that you read the next paragraphs.

We will show you how to learn the best strategies from the most experienced traders and how to improve your financial preparation and training, all for free, are you ready? Then let’s get started!

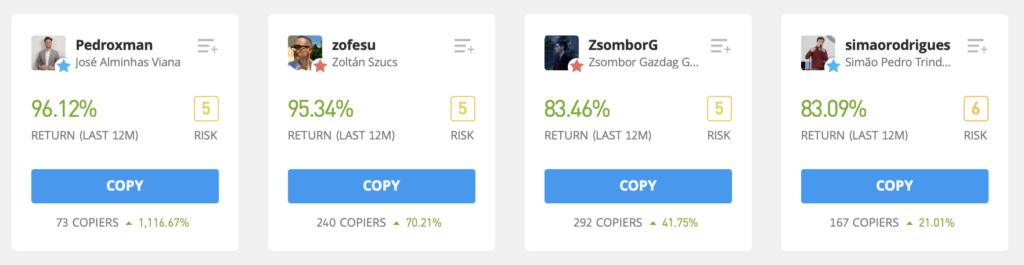

Copy the best traders

The best way to understand how seasoned traders like Bill Ackman move is to look at their trades in real time.

Not only is it possible, but thanks to a patented tool, we will show you how to copy the market trades of these capable investors.

eToro is one of the most popular online brokers on the planet, has obtained several international licenses and operates in Europe with a CONSOB and CySec authorization.

In addition to offering numerous assets and securities through CFDs, with an intuitive platform full of operating tools, eToro has also patented Copy Trading, the automatic system to which we have referred.

Thanks to Contracts for Difference you can trade without paying commissions and Copy Trading allows you to choose the traders you prefer, among those who use eToro. With a click, the software automatically copies the operations carried out by these market experts to your account.

Let’s see how this auto trading tool works:

- Register for free on eToro

- Log into your demo or real account

- In the “Copy People” area, choose the traders to copy

- Copy Trading will copy on your account all the market operations carried out by the traders you have selected

This feature offers you two great advantages:

- You will learn the strategies and operating methods of the best trading experts who trade on eToro

- You will get the same returns as these traders, fully automatically

- Better to select at least 5 or 6 traders to copy, so as to diversify your investment and learn different strategies

Here are some of the best eToro traders that you could copy with one click:

Best Trading Course

Not everyone likes to study, but to trade on the markets it is not enough to copy the strategies of the most experienced traders, you also need to understand what they do if you want to become a trader like Bill Ackman.

Here a Trading Course can be the right solution, but not one of those courses designed to steal money and leave you little or nothing. We have selected the best Free Trading Course on the market and we have decided to offer it to you.

This course was developed by an internationally renowned online broker: ForexTB.

ForexTB is a CFD Broker who has focused heavily on training and services aimed at improving the results of its users.

It operates throughout Europe with a prestigious CySEC license and its offer of assets and securities is very complete.

The Trading Course we were talking about is a very well done ebook, with the basic rules of online trading, technical analysis and the tools and indicators to be used to make a profit.

The pdf is totally free and will allow you to understand the choices underlying the market operations made by Ackman and the best performing traders in the world.

Start improving your training now, here is the official link to download the course:

Download the Trading Course for free by clicking hereBill Ackman Strategy

Understanding Bill Ackman’s strategy is not at all simple but you can analyze his moves and his past investments to get an idea of what moves his choices.

At the base there is always an in-depth analysis of the market, both from a fundamental and a technical point of view.

After that Ackman evaluates if there is room for a substantial profit, hardly aims for small profits, some of his operations have made over a billion dollars.

He does not take into account the judgment of others, much less that of the famous rating agencies, which have often proved to be somewhat short-sighted.

He does not disdain short selling and it is also for this reason that we have proposed CFD brokers to try your hand at his strategies. In fact, these intermediaries also allow short selling and not all brokers do it.

In addition, CFD Brokers always offer a Demo account, with which you can practice, test Ackman’s strategies and what you have learned in the Trading Course, without risking money.

In the next paragraph we talk about the famous 8 principles on which Bill Ackman’s investments are based and which serve to give you a complete picture of his investment philosophy.

Bill Ackman 8 Principles

Ackman established principles that guide his investment strategies, and he himself realized that when he suffered losses, he actually did not follow these principles, deviating from his trading strategy.

So let’s see what are the 8 principles of Bill Ackman:

- Business must be simple and predictable. It must be clear how the company earns and what its future prospects are.

- The company must have a dominant position on the market. It must have something that protects it from competitors.

- Risk exposure from external factors must be limited.

- The company must be able to generate high returns without debt.

- The company must have “entry barriers”, such as a patent or a monopoly.

- The company must be managed by excellentmanagement and must be led in a unique way, without internal disputes.

- The company must have an excellent ROI (Return on investment) to be preferred to ROE (return on capital including any debts).

- The company’s balance sheet must be very strong and stable, allowing it to maintain operations and encourage growth without having to resort to debt or capital increases.

Bill Ackman investments

Bill Ackman’s investments began with Gotham Partners in the early 90s and then continued in 2004 with the foundation of the famous hedge fund: Pershing Square Capital Management.

This fund started with 54 million of Ackman’s personal funds.

The fund immediately used a portion of the capital to invest in the fast food chain Wendy. Before long, Ackman exerted his influence on the chain’s board of directors to push shareholders to get rid of the Tim Hortons brand.

This brand is very popular and the IPO with which it is spun off from the Wendy chain is a success.

Unfortunately, the Wendy chain, without that brand, loses a lot of value, but Ackman, who had orchestrated everything, sells at the right time, making a huge profit.

In 2012 Bill created a closed-end fund (similar to Jim Simons’ Medallion Fund), the Pershing Square Holdings in 2012 and went public with a capitalization of $ 3 billion.

Bill Ackman’s personal net worth is estimated at $ 1.9 billion, but you have to keep in mind that this investor is also a great philanthropist, who has pledged to donate at least 50% of his wealth to charity.

Conclusions

Considered one of the most daring and courageous traders of the present day, Bill Ackman has put in place some of the most profitable financial operations of the last few decades.

His strategy is guided by his 8 principles, which must never be violated. If he serves, Ackman is not afraid to go down, in fact it is precisely in this way that he has obtained some of his biggest profits than him.

If you want to understand the choices of this great investor, it is not enough to memorize his principles, it takes training and a lot of practice.

Initially, even if you cannot directly copy Bill Ackman’s operations, you can copy that of eToro’s most experienced traders, thanks to Copy Trading.

Try Copy Trading in Demo, without making any deposits and without taking risks, you will immediately understand the enormous potential of this automatic trading tool:

Click here and get free access to Copy TradingTo improve your preparation in terms of investments and online trading, we suggest you download and study the Trading Course created by ForexTB. It is the best free trading course on the market, here is the link to download it:

Download the Trading Course for freeThe fund is called Pershing Square Capital Management.

In 2019, the return on this fund was 58.1%.

Its trading strategy is based on the analysis of the market and the company, which must have certain characteristics.

Bill Ackman’s personal fortune is estimated at $ 1.9 billion.