Bitstamp Review: is it safe? Fees?

Cryptocurrencies are very popular with new investors and you need an intermediary to buy and sell them. Bitstamp is one of the longest-running and most popular exchanges in the world, but is it also safe and convenient?

We have made a detailed review that shows all aspects of this exchange and compares it to online brokers such as eToro, which allow you to trade cryptocurrencies.

| Platform: | Bitstamp |

| ❓ What is it: | Cryptocurrency Exchange |

| 🧾 Regulation: | None |

| 💸 Fees: | 0,25 % + fees deposits/withdraws |

| ❌ Free Demo Account: | No |

| 💻 Best Alternatives: | eToro / ForexTB / Trade.com |

Fortunately, today there are many cryptocurrency platforms that follow ESMA regulations and are therefore safe. We immediately report eToro because it is the only platform that allows you to automatically copy what the best cryptocurrency investors do.

You can sign up for free on eToro by clicking here

|

Platform: etoro Min. Deposit: 50€ License: Cysec |

|

|

|---|---|---|---|

|

Platform: xtb Min. Deposit: 100€ License: Cysec |

|

|

|

Platform: iqoption Min. Deposit: 50€ License: Cysec |

|

|

|

Platform: ubrokers Min. Deposit: 250€ License: Cysec |

|

|

|

Platform: trade Min. Deposit: 100€ License: Cysec |

|

72.30% of retail CFD accounts lose money

|

|

Platform: forextb Min. Deposit: 250€ License: Cysec |

|

|

Index

What is Bitstamp?

Bitstamp is a cryptocurrency exchange, which is a website that allows you to buy, sell and trade five different cryptocurrencies.

The website was launched in 2011 and has become very popular because it allows you to buy cryptocurrencies even using Fiat currencies such as Euro and Dollar.

Bitstamp was founded by Nejc Kodrič and Damijan Merlak in Slovenia. It was one of the first competing exchanges of the then popular Mt.Gox (which sadly failed dramatically).

At the end of 2018 Bitstamp was acquired by NXMH, a company based in Belgium.

Is Bitstamp worth it?

Let’s go in order: having been launched in 2011, Bitstamp is one of the platforms with the most experience in the exchange sector. This, on the one hand, could guarantee the reliability of the service: on the other hand, how could it last so long if it were not valid?

However, experience has taught us that, in this sector, trusting is not the right technique. Unfortunately, we have to deal with the absence of a defined regulation that involves all operators in the sector and therefore offers non-existent protection to users of exchanges.

How then to invest in cryptocurrencies eliminating the risks not strictly related to trading?

The ideal is to contact certified platforms, placed under the supervision of European entities such as CySec and with authorization to operate in Europe (issued by CONSOB or CySec).

The exchange sector, in fact, enjoys a reputation that is anything but positive. Think of the aforementioned Mt. Gox, known to have disappeared (and made its users’ funds disappear) in a very short time, despite a semblance of reliability.

This is just the tip of the iceberg, one of those names that have risen to the headlines precisely because of the fame it had managed to obtain and which clearly demonstrates that not even the largest platforms can give guarantees. Bitstamp itself has had to deal with several problems (which we will analyze later) and which lead us to evaluate more reliable alternatives.

With this we absolutely do not want to question the honesty of the founders of Bitstamp: the exchange has shown its intentions over the years and we are quite sure that it is not a scam. Unfortunately, even the best in this field have to deal with some structural problems.

Where is it worth investing then? An interesting solution is offered by eToro, which allows you to trade both real stocks and CFDs (see the catalog here).

This means that you can buy and sell cryptocurrencies in the traditional way, by purchasing the tokens to be kept on a wallet (internal or external to the platform), or trade with the free CFDs that the platform makes available to you.

What are CFDs? A little more patience and you will find out.

Bitstamp: Pros and Cons

Obviously Bitstamp is not suitable for everyone, so to understand if it is suitable for your trading needs it is best that you read this review in full.

To give you an idea of the characteristics of Bitstamp, we have briefly listed the Pros and Cons of this exchange.

Pros

- Accept debit / credit cards and bank transfers

- Available for all countries (if depositing with cryptocurrency)

- 24/7 phone support

- Good selection of charting tools

Cons

- Only 5 cryptocurrencies are available, many of the emerging cryptocurrencies are missing

- Impossible to invest downwards (short selling)

- Expensive trading and deposit fees

- Limited number of countries supported for debit / credit card deposits

- A major intrusion in 2015 resulted in the theft of 19,000 Bitcoins

- Slow verification during registration

- Lack of an official license

- No deposit guarantee

At this point it is right to evaluate if there are alternatives with fewer defects and some more merits, especially in terms of safety.

Bitstamp alternatives

The alternatives to Bitstamp are other cryptocurrency exchanges and commission-free CFD brokers.

The main cryptocurrency exchanges such as Coinbase, Binance, CEX, Bitpanda, Gemini, Coinmama, Bittrex, The Rock Trading and Kraken have similar characteristics to Bitstamp and therefore the same defects, albeit with some small differences.

CFD brokers, on the other hand, are intermediaries that allow you to invest in cryptocurrencies without owning them directly.

These contracts (CFDs) have the same price as the traded cryptocurrency and allow you to buy or sell it (short) without paying commissions.

The only flaw of CFD Brokers is the fact that cryptocurrencies cannot be used to make purchases of services and products.

Few people are interested in buying items with Bitcoins, but if you are one of them, then you need an exchange like Bitstamp and a cryptocurrency wallet.

If, on the other hand, you are just looking to make money from the price changes of cryptocurrencies, or you are interested in trading, CFD brokers are perfect. Here are pros and cons of CFD brokers for cryptocurrencies.

Pros

- They accept debit / credit cards and bank transfers

- Available for all European and some non-European countries

- 24/7 phone support

- Great platform for charts

- You can also invest downwards (sell short)

- No commissions

- Security like that of a bank

- Deposit Guarantee

- Operational license issued by CONSOB or CySEC

Cons

- You don’t “physically” own cryptocurrencies

Best alternatives to Bitstamp

We have seen the advantages of CFD brokers over cryptocurrency exchanges but these brokers are not all the same, so we have decided to offer you those that in our opinion are the most suitable intermediaries to trade cryptocurrencies in total safety.

They are all commission-free online brokers, therefore much cheaper than Bitstamp and equipped with a regular operating license issued by CONSOB or CySec.

eToro

eToro is the most widespread and used online broker in the world, very reliable, safe and convenient.

Its trading platform is perfect for trading cryptocurrencies or any other asset and the CONSOB license offers additional security.

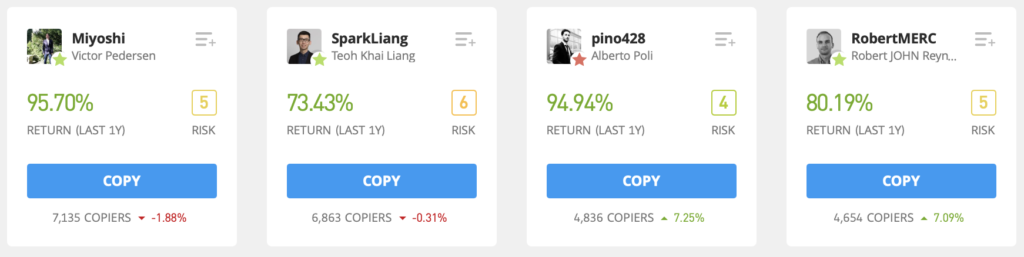

But the most popular feature of eToro is its automatic investment system: Copy Trading.

Copy Trading allows you to copy the market operations of the best traders in the world (who operate on eToro) without costs and automatically.

To use Copy Trading you need to follow these steps:

- Register on eToro with the link at the end of the review

- In the People section you can choose the traders to copy, based on their performance (filtering those who invest in cryptocurrencies)

- With a click, Copy Trading will copy the operations of the chosen traders to your account

- At that point you will get the same returns as these trading experts (in proportion to the amount invested in them), automatically

Here are some of the traders that can be copied on eToro:

The “manual” and “automatic” investments on cryptocurrencies can also be tested on a free Demo account, without running any risks, because in demo the money is virtual.

Click here to register for freeFor more details you can read our full review about eToro.

ForexTB

ForexTB offers a number of free services which have made it very popular with traders.

The CySEC license certifies its reliability at European level and offers two trading platforms:

- The Web Platform is accessible from any web browser and works on any device without downloading any software.

- Metatrader 4, more technical and rich in professional indicators, responds to the needs of the most experienced and demanding traders.

To learn how to trade, you need to know technical analysis and ForexTB offers a free course. This is a very well crafted ebook, one of the best, which explains online trading clearly.

Click here and download the trading course for freeBut ForexTB also points to operational support, essential for traders, by offering free Trading Signals. These indications are very reliable and have a 70% success rate.

To receive ForexTB Trading Signals for free, click hereRead our ForexTB review for more information.

Trade.com

Trade.com is a very popular broker in the world of cryptocurrency trading, especially for the very low deposit threshold.

It operates under the CONSOB license, so safety is guaranteed. Its platform is among the most intuitive on the market, suitable for any type of investor.

For trading newbies, Trade.com offers a free downloadable course. It is an ebook that explains the basics of technical analysis without too many technicalities.

Download the free course by clicking hereThe training offered by this Broker continues with an educational area full of courses and information on every aspect of trading, and it is all free, available to users.

When investing, you initially want to risk little money and Trade.com allows you to open a real account with only 100 Euros of minimum deposit.

But for those who want to reduce the risks to zero, there is always a free and unlimited Demo account. It is identical to the real account but the money is virtual.

Click here to sign up for freeIf you want to know more, you can read our Trade.com review.

Bitstamp, how it works

After having seen the strengths and weaknesses of Bitstamp and the main alternatives, let’s go into the details of how this cryptocurrency exchange works.

First you need to open an account on Bitstamp, send the required documents and wait for verification. Many have complained of excessive slowness in this phase, but it is only to be done once.

Bitstamp acts as an intermediary between buyers and sellers, so if you buy a cryptocurrency, somewhere there will be someone who is selling it.

It is not Bitstamp that sells you Bitcoins (or another cryptocurrency) but only facilitates the transaction.

Of course, Bitstamp charges itself for this service by charging commissions that we will see in the next paragraph.

One of the main limitations of Bitstamp is that it does not allow you to sell short, to aim downwards.

With this exchange you can “earn” only if a cryptocurrency increases in value, but you cannot invest in the drop in price.

This is a very serious disadvantage for traders, who very often make bearish trades, it is part of the main trading strategies.

Bitstamp Fees

Bitstamp’s fees are mainly of two types: for trading and for deposits and withdrawals.

Let’s quickly see the first ones: trading commissions are 0.25% of each transaction made.

For example, if you buy cryptocurrencies worth $ 1,000, the trading fee will be $ 2.50. At the close of the operation, when you sell the cryptocurrency, you will have to pay again.

For professionals or fund managers who trade over $ 20 million a month, commissions drop to 0.10%.

Bitstamp’s trading fees are very expensive even compared to other exchanges, which are almost all cheaper.

Bitstamp withdrawal and deposit

As mentioned, Bitstamp also asks for commissions for money transfers: deposits and withdrawals.

Deposit fees:

- Debit Cards: $ 10 flat fee. For deposits over $ 10,000, 2% is charged

- Credit cards: 5% of the deposit amount (plus any fees charged by the credit card provider)

- SEPA transfer (European Bank Transfer): free

- Traditional bank transfer: transaction fee of 0.05% (minimum / maximum € 7.50 / € 300)

- Cryptocurrency: free

Withdrawal fees:

- Withdrawals by credit or debit card: not available

- SEPA transfer (European bank withdrawals): € 0.90

- Bank transfer: transaction fee 0.09% (minimum € 15)

Is Bitstamp safe?

The security factor is fundamental in cryptocurrency trading and investments in general.

Bitstamp, like all cryptocurrency exchanges, does not offer any guarantees to cover the deposits made.

Or rather, it has no external guarantees, those deriving from a license such as that of CFD Brokers, which covers up to 20,000 even if the Broker should go bankrupt.

If Bitstamp fails, there is no body that will give you your money back.

It has no license and in theory it could make all your money disappear and close as did Mt.Gox, the famous exchange that has “lost” about 850 thousand Bitcoins (about 8 billion dollars at current value) deposited by its customers.

Exchenge has a crunchy history of breaches, thefts, and hacks, and Bitstamp is not immune.

Despite the exchange’s intentions to protect customer funds, unfortunately it has suffered numerous hacks and therefore we cannot say that Bitstamp is safe, far from it.

In any case, at least Bitstamp is not a real scam like Bitcoin System.

In 2015, Bitstamp suffered the theft of over 19,000 Bitcoins from customer deposited funds.

That money would be worth about $ 180 million today.

But it is not the only hacker attack that Bitstamp has suffered, it is only the most sensational.

Bitstamp reviews and opinions

Bitstamp reviews are not flattering, on a popular review website, this exchange is rated as “poor”, with a 2.3 rating out of 5.

Unfortunately, the fact of not possessing a license is not only a question of legality but also concerns the impossibility of contacting an entity (such as CONSOB) in the event of a wrong or worse, a theft.

Below we have fully transcribed the opinion of a Bitstamp user who complains about the security problems of this exchange:

Simply scam … you send the money and they keep it. Who protects you? Nobody! Get a lawyer? It costs you more than what you sent as money.

Years ago it worked… like mtgox…. we all know how mtgox ended… stolen money and cryptocurrencies and went bankrupt!Forget it if you don’t want to lose money.

A former customer!

Conclusions

We have described how Bitstamp works and its peculiar characteristics. The defects of this exchange are much greater than the merits, it is expensive, limited and without any guarantee.

- If you want to invest in Bitcoin and cryptocurrencies, rely only on regularly authorized online brokers.

Before depositing any money, do some tests in the Demo accounts offered by these CFD Brokers, you will be able to evaluate the functioning of the trading platforms without running any risk.

- Access the eToro Demo account for free by clicking here

- Register for free on ForexTB and access the Demo account from this link

- Access the Trade.com Demo account for free by clicking here

Bitstamp is a popular cryptocurrency exchange.

It is not licensed and offers no external deposit guarantees, read the review for more details.

Bitstam charges transaction fees, find out if it’s worth it by reading our review.

eToro and CFD Brokers are safe alternatives to Bitstamp. They also don’t charge commissions.