![Luxottica [EssilorLuxottica]](https://www.onlinetradingcourse.net/wp-content/uploads/2021/10/image-1.jpeg)

Buy Luxottica Shares [EssilorLuxottica]

Luxottica is a historic Italian brand that has made its way into the world of eyewear in a disruptive way, to become a world leader in the sector. Buying Luxottica shares means investing in the likes of Ray-Ban, Persol and Oakley. But is it the right time?

To find out we will evaluate:

- The situation after the merger with Essilor

- The future prospects of the sector

- The forecasts of the main international analysts

At the end of our guide you will have a 360 ° perspective on the Luxottica stock and on the actual growth prospects.

We would also like to advise you on the best brokers to buy Luxottica shares (or sell them short) without paying commissions. We are talking about intermediaries such as eToro, which among its flagships boasts Copy Trading, a revolutionary tool that allows even less experienced traders to earn like a professional.

How? Simply by copying the operations of the best traders registered on the platform.

Invest like a pro with eToro Copy Trading| 📊 Asset: | 😎 Luxottica |

| 🔢 ISIN: | FR0000121667 |

| ✔️ Ticker: | EL |

| 🏛 Listing: | Milan stock exchange |

| 📍 Where to buy: | eToro / ForexTB |

| 💶 Starting capital: | 100 € |

Index

Luxottica Shares: live price

The chart shows the price of Essilor Luxottica stock today. In addition to the current value, the tools present also allow you to check the closing prices of the past few days to get a clear idea of the current trend.

Luxottica shares: little history

The history of Luxottica begins in 1961, when Leonardo del Vecchio founded the company in Agordo, near Belluno in Italy.

Luxottica’s headquarters are currently in Milan and the company designs, manufactures and sells numerous eyewear brands. Luxottica also makes frames for some of the most famous designers in the world, such as Chanel, Prada, Giorgio Armani, Burberry, Versace, Dolce and Gabbana, etc.

Del Vecchio starts out as an apprentice and transforms his manual skills and creative flair into the eyewear company we all know.

Luxottica grows rapidly, absorbing numerous companies in the sector and expanding on a territorial level until arriving in New York in 1990.

It was listed on the stock exchange in 2000 and 3 years later it became part of the FTSE Mib. The money raised allows him to acquire companies of the caliber of Persol, Ray-Ban, Sunglass Hut and Oakley.

But the real turning point came in 2017, when Luxottica announced the merger with Essilor, creating a giant with a capitalization of 57 billion euros: EssilorLuxottica.

EssilorLuxottica

EssilorLuxottica is the Franco-Italian multinational born on 1 October 2018 from the merger of the Italian Luxottica with the French Essilor.

This merger spawned the world’s largest eyewear and lens group, with over 20 premium brands.

The company, as well as on the Italian Stock Exchange, is also listed on the Euronext in Paris, with the ticker EL and has been included in the CAC 40 and in the Euro Stoxx 50, two of the most important stock market indices in Europe.

How to buy Luxottica Shares

The popularity of Luxottica and the new EssilorLuxottica conglomerate always attracts new investors, but how do you buy Luxottica shares?

There are two main alternatives: direct purchase or CFD trading.

Direct buy

Speaking of “buying shares”, the immediate association is to buy the stock, keep it in a deposit account and wait for the distribution of dividends or an increase in its value sufficient to justify the sale.

It is therefore the traditional concept linked to the purchase and sale of shares, limited to the possibility of investing only upwards (thus accumulating losses in the event that our stock were to fall) and bound to the mediation of a banking broker.

Mediation that brings with it various expenses, from the opening of the securities account, to the costs associated with it, up to the commissions on the execution that can have a heavy impact on profits, especially for less capitalized traders.

Apparently, therefore, the direct purchase of shares does not seem to be the best choice for a novice investor or one who cannot rely on large capital.

Is this actually so? The answer is that there are alternatives that allow you to make the most of all market conditions and optimize the timing of your investment: CFD, Contract for Difference.

CFD Trading

The simplest and most affordable method is to take advantage of CFD Brokers, intermediaries that allow you to trade the stock through Contracts for Difference.

The advantages of CFD Brokers are these:

- They allow you to trade both up and down (sell short)

- They don’t charge commissions

- They are safe and regulated by bodies such as CONSOB and CySEC

These features must never be missing when choosing your online broker.

The lack of commissions offers a very cheap online trading, also suitable for investing small amounts and making very frequent operations.

Furthermore, it is not necessary to have large capital, with a few hundred euros you can buy Luxottica shares in total safety.

Where to Buy Luxottica Shares

We have seen that online brokers offering CFDs are the ideal solution to buy Luxottica shares, but which broker should we use?

The choice is very personal. The best way to evaluate these brokers is to test their trading platforms, compare the services they offer and select the most suitable for your way of operating in the markets.

If you want to speed up the times, we at OnlineTradingCourse.net have already carried out numerous tests and we would like to recommend you the best brokers on the market: eToro and OBRinvest.

Among these the choice is really personal, register for free and try the Demo account of all 3 Brokers, at the end of the guide you are reading you will find the official links to register.

After testing the best trading platforms in Demo, you will have a clearer idea about the broker to use to buy Luxottica shares.

Here are some brief reviews on these brokers:

eToro

The most widespread and used online broker in the world is eToro and it is not only popular, it also offers a very intuitive platform and a series of services of the highest level. Furthermore, the CONSOB license confirms its absolute reliability.

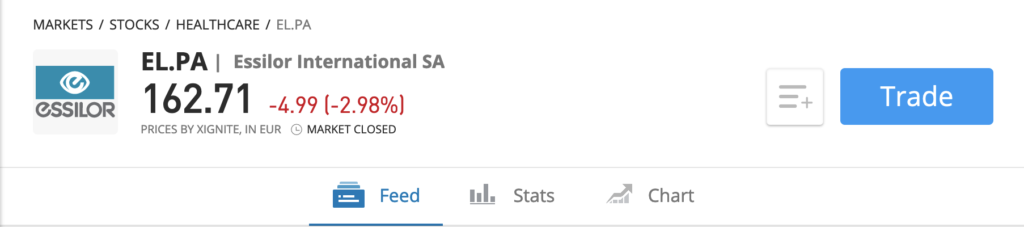

eToro has surpassed 10 million users worldwide and we want to show you what the EssilorLuxottica CFD looks like in this broker’s trading platform:

To buy Luxottica shares with eToro, just click on “Trade” in the Essilor CFD shown above and decide how much to invest in the operation.

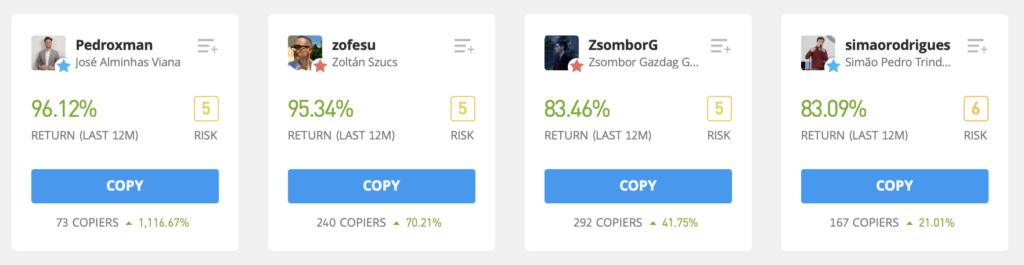

Try the eToro platform for freeIf you prefer automatic ones to studying charts and investing independently, eToro has the right service for you: Copy Trading.

This eToro invention allows you to copy the operations of the best traders in the world (chosen by you on eToro), all automatically and without additional costs.

Let’s see how Copy Trading works:

- Register on eToro, it's free

- In the “People” section you can choose the traders to copy, based on numerous parameters.

- Select the traders and click “Copy”

Copy Trading will copy the operations performed by the chosen traders into your account, At this point you will get the same returns as these experienced traders, at no additional costs.

Your profits depend on the returns of the traders you have selected. We show you some examples to understand what figures we are talking about:

Before depositing money into the eToro account, you can do all the tests you want on the free and unlimited Demo account. You will have the opportunity to safely test both “manual” investments and Copy Trading and only then will you decide how much to invest in EssilorLuxottica, in total safety.

Click here to sign up for free on eToroForexTB

What has made this broker famous is the attention paid to learning and training, which has attracted many new investors.

ForexTB wants to make trading simple and customizable. For this it offers two trading platforms to choose from, both free:

- Metatrader 4 is a very technical platform, with a series of very customizable tools and indicators.

- The web platform is very versatile and allows access from any browser, without downloading or installing anything.

Buying Luxottica shares is simple, just select the corresponding CFD, click on Buy or Sell (to aim down) and choose the investment amount.

Register for free on ForexTB by clicking hereOf course ForexTB is a safe and regulated broker, which boasts a CySEC license valid throughout Europe.

The training we have mentioned becomes concrete with the possibility of downloading a Trading Course specially created by ForexTB for free.

This ebook is the world’s most downloaded foundation course in this industry. It explains how online trading works and how to invest in the markets and allows anyone to fully understand technical analysis. To download it for free you can use the link below:

Click here and download the Trading Course for freeIs it worth buying Luxottica shares?

The Italian Luxottica LUX.MI and the French Essilor ESSI.PA have merged to create the leading company in the eyewear and lens sector with an annual turnover exceeding 16 billion euros.

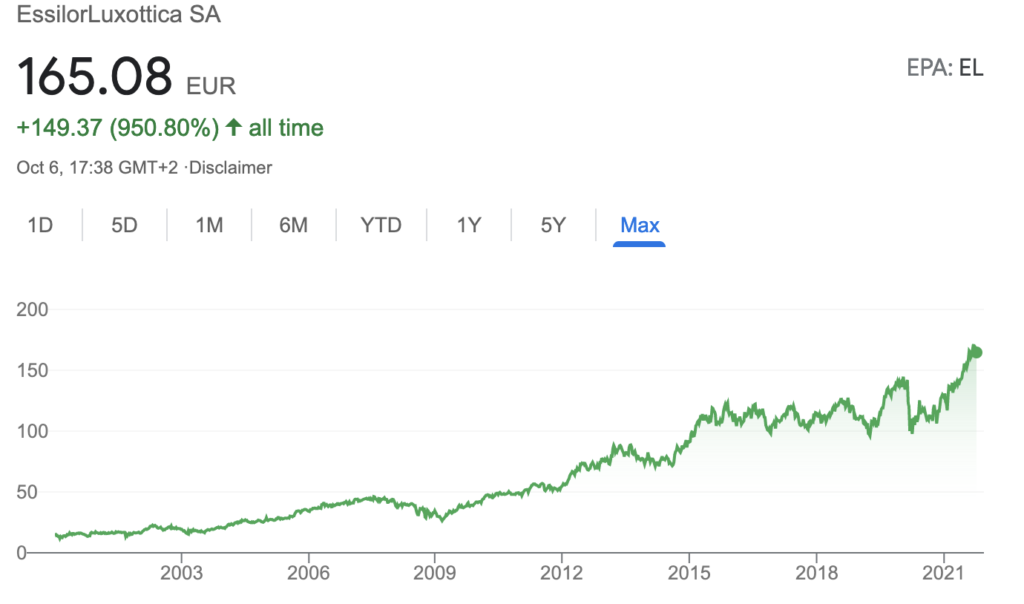

If we look at the historical trend of the EssilorLuxottica stock (formerly Luxottica) we see a steady growth in the share price, up to the collapse of the markets which occurred in March 2020 due to the outbreak of the global pandemic.

The agreement between these two companies (Essilor and Luxottica) has led to a giant of global dimensions with solid economic foundations.

Buying Luxottica shares can certainly be an excellent investment but the critical period we are going through makes this investment suitable for position traders.

This means that the growth of the EssilorLuxottica stock is very likely but it will take some time, it is not a short term investment.

The merger of the main players in the eyewear market has a long-term goal from a corporate point of view as well. EssilorLuxottica wants to meet the demand for eyewear that is set to grow due to the aging of the global population and the growing awareness of eye care.

Business Model

EssilorLuxottica designs, manufactures and distributes ophthalmic lenses, frames and sunglasses throughout most of the world.

The company brings together the complementary skills of two industry pioneers, one in advanced lens technology (Essilor) and the other in the craftsmanship of iconic eyewear (Luxottica).

Eyewear brands including Ray-Ban and Oakley along with the famous Varilux and Transitions lenses are just some of the brands that are part of the EssilorLuxottica family.

Competitors

There are no companies that can compete on an equal footing with EssilorLuxottica, but the main competitors are the main companies operating in the same sector, among which we find:

- Marcolin

- Safilo

- Marchon

- Zeiss

- Kering

- CooperVision

- Amplifon

Forecast

Analysts’ forecasts estimate constant growth for EssilorLuxottica’s turnover, an increase that will amount to between 2% and 4% per year given the steadily increasing demand, both for eyewear and lenses.

In the graph below we see the last 6 months of the EssilorLuxottica stock and the general trend is in slow but steady growth.

This is an evolution that gives investors great optimism, after the fluctuations caused by the global economic instability resulting from the coronavirus pandemic and its consequences.

In the short term, analysts are not unbalanced, but in the long term they are more inclined to a resumption of the growth of the stock on the stock market.

The general rating on EssilorLuxottica shares is in favor of the buy over the medium to long term, expecting an outperformance in the weeks to come.

What will happen in the next 12 months instead?

Buy Luxottica Shares Target Price

We analyzed the forecasts of 22 of the major international analysts who have issued valuations for EssilorLuxottica in recent months.

At present, the purchase orientation prevails, with 13 analysts who have exposed themselves in this direction. Only 3 suggest selling, while 6 remain neutral.

At best, the target price could achieve growth of more than 20% in the next 12 months, even if the average values tell us of an improvement in line with the current trend: slow and constant.

Conclusions

This guide has shown a global overview of the economic situation of EssilorLuxottica, considering the merger that led to this giant multinational.

Buying Luxottica shares can be an excellent investment, but it is necessary to have a long-term perspective, invest and wait patiently for the recovery of the stock.

To face this investment with the right determination it is advisable to start with the Demo accounts to “practice”. In these accounts the money is virtual but the platform allows you to evaluate the strategy adopted and test the tools offered by the Broker.

Here are the official links to access the Demo accounts of the best online brokers for free:

- Access the eToro Demo account for free by clicking here

- Register on ForexTB and try the Demo account by clicking here

Yes, in a long-term perspective the stock is considered an excellent investment.

Leading international analysts are bullish on EssilorLuxottica shares.

The 12-month target price for the EssilorLuxottica share is € 128.85 per share.

CFD brokers like eToro offer the best platforms to invest safely on Luxottica, without paying commissions.