Buy Moderna Shares: The Complete Guide

Pharmaceutical and biotech companies offer investment opportunities that are often underestimated by ordinary investors. Buying Moderna shares might actually be a great trading opportunity, but is it the right time to invest?

We have carried out an analysis on the company, on the stock, and on the forecasts of the major analysts, in order to show you what we can expect from Moderna shares in the near future.

We will also highlight the steps necessary to invest in assets, which we can summarize in 3 steps:

- Choose a CFD Broker that offers a safe and intuitive platform.

- Practice on the Demo account without taking risks.

- Make a small deposit to invest on the real market.

OnlineTradingCourse.net has selected the best platforms to buy AMD shares without paying commissions, one of which is offered by eToro, the market leader.

|

Platform: etoro Min. Deposit: 50€ License: Cysec |

|

|

|---|---|---|---|

|

Platform: xtb Min. Deposit: 100€ License: Cysec |

|

|

|

Platform: iqoption Min. Deposit: 50€ License: Cysec |

|

|

|

Platform: ubrokers Min. Deposit: 250€ License: Cysec |

|

|

|

Platform: trade Min. Deposit: 100€ License: Cysec |

|

72.30% of retail CFD accounts lose money

|

|

Platform: forextb Min. Deposit: 250€ License: Cysec |

|

|

Index

Buy Moderna Shares: Real time quotation and price

Moderna: History

The Moderna company is a biotechnology company based in Cambridge, in the USA. The focus of this company is the research and production of drugs and vaccines based on the messanger RNA.

Few companies in the sector are pursuing research in this field due to the side effects of these drugs.

In parallel with these researches, since 2014, Moderna has focused on more “classic” vaccines that have the task of financially supporting society.

In December 2018, Moderna went public on NASDAQ with the largest biotech initial public offering (IPO) in history, raising $ 600 million for 8% of its shares, which implied an overall valuation of 7,5 billion dollars.

Moderna is currently valued at around $ 30 billion, backed by the Covid-19 vaccine research.

Indeed, Moderna’s vaccine has demonstrated efficacy of over 94% and will be distributed by December 2020. Moderna has won the Coronavirus vaccine contest and, probably, its prices will be amply rewarded by this victory .

How to buy Moderna shares

Despite being listed on NASDAQ, one of the most iconic stock indices in the world, it is not that complicated to buy Moderna shares. You need a PC, an internet connection, and a reliable CFD Broker.

In order to identify a reliable Broker you need to verify that it has the following requirements:

- It must offer CFDs, contracts for difference, that allow you to invest both up and down (short selling).

- You don’t have to pay commissions.

- It must have the authorization of at least one supervisory body such as FCA or CySEC.

To buy Moderna shares (or sell them) on one of the trading platforms offered by these online brokers you need to:

- Buy the Moderna CFDs to earn money if the stock goes up.

- Sell Moderna CFDs to earn money if the stock goes down.

When the stock reaches the expected price, the transaction can be closed and any net profits collected, without paying commissions.

Where to buy Moderna shares

CFD brokers are certainly the most practical, safe, and economical intermediaries where to buy Moderna shares. But how do you choose the right broker?

It may seem like a difficult undertaking, because it would be necessary to carry out a series of tests on the best trading platforms, evaluate the services offered, and compare them.

nlineTradingCourse.net has already carried them out and concluded that the best CFD brokers where to buy AMD shares safely are: eToro, ForexTB and Trade.com.

Below you will find a brief description of these platforms, but in the end you will be the one to choose the one that best meets your needs. Sign up, do some tests in the Demo version without risking money, and select your favorite Broker.

eToro: Buying Moderna shares with an intuitive platform

eToro with its community of over 7 million active traders is the leader of the market.

The security of this intermediary also derives from its numerous licenses, such as that of FCA.

The most interesting feature of eToro is its platform, which is fast and intuitive like few others.

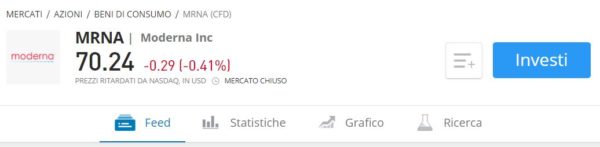

Below the Moderna stock:

To buy Moderna shares (or sell them), you have to click on “Invest”, decide whether to Buy or Sell the stock, and how much to invest in the operation.

Its fame comes not only from the intuitive platform but also from a revolutionary patent called Copy Trading.

This system allows you to copy the market transactions of the best investors in the world (chosen directly on eToro), in a fully automated manner and at no additional cost.

To use Copy Trading you have to follow these steps:

- Register on eToro

- In the section “people”, you can choose the traders to copy based on the performance.

- With a click, Copy Trading will copy exactly the same operations of the chosen traders in your account.

- At this point, you will get the same returns as these trading experts (of course, in proportion to your investment), without doing anything else.

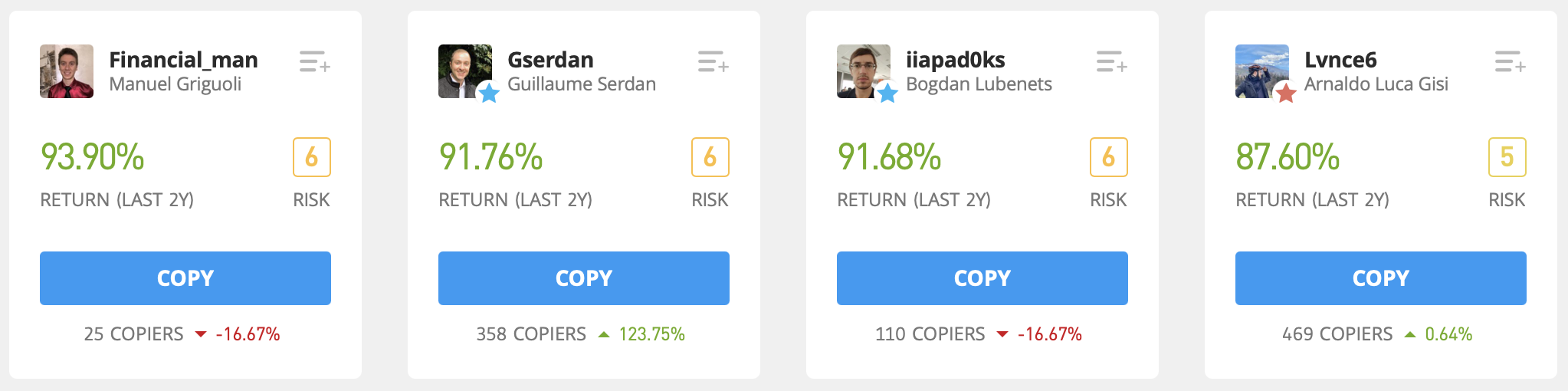

Here are some of the best eToro Traders (which can be copied):

Click here and choose which trader to follow

Both Copy Trading as well as traditional trading can also be tested on a free Demo account, without taking real risks.

Click here and sign up for free

For more details you can read our full eToro review.

ForexTB: Buying Moderna Shares Thanks to the Trading Signals

ForexTB has achieved its current popularity thanks to a series of completely free services.

Clearly, this broker is also absolutely safe and can boast the authorization of the prestigious CySEC, valid throughout Europe and the UK.

ForexTB allows you to choose between 2 trading platforms, both free:

- The web platform is easy to use and can be entered from any browser without downloading any software.

- Metatrader 4 is more technical and full of professional indicators and meets the needs of the more experienced traders.

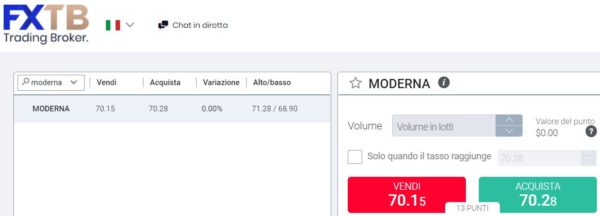

To buy Moderna shares (or sell them) simply click on Sell or Buy and decide how much money to invest in the operation.

ForexTB’s famous trading support is based on the Free Trading Signals which are sent to all investors. These indications are very precise and are successful 70% of the time, an excellent support for online trading.

Click here and download the trading course for free

ForexTB tries to help above all novice traders and for this reason, it has created for free a Trading Course considered among the best in its category. This ebook summarizes the basics of online trading and allows you to learn technical analysis in a simple way and with practical examples.

Click here and download the trading course for free

Trade.com: Buy Moderna shares with € 100 deposit

Trade.com notoriety has spread incredibly thanks to its very professional platform and to the entry threshold.

The minimum deposit required by Trade.com to open a real account is in fact only 100 Euros, much lower than the average on the market.

The security of this intermediary is guaranteed by FCA.

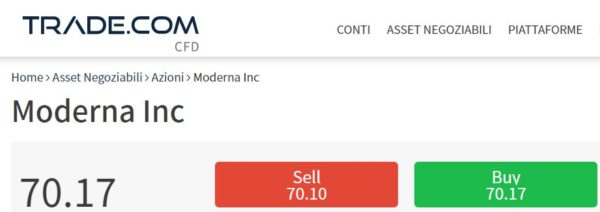

In the screenshot below, you can see the Moderna CFDs:

To buy (or sell) Moderna shares, just click on Buy or Sell and decide how much to invest.

Click here to sign up for free

Trade.com relies heavily on training, which is necessary to improve the performance of its users. The notions of technical analysis are the basis of a good profit in trading and this Broker has created a very complete trading course, a pdf that can be downloaded for free using the link below:

Download the free Trade.com course by clicking here

To open a real account with Trade.com you need at least 100 Euros, an amount lower than the average. However, to get started there is always the totally free and unlimited Demo account.

Click here to sign up for free

Moderna: Business model

Moderna’s business model is based on research and treatment of infectious diseases, oncology, rare diseases, and cardiovascular diseases – mainly using messenger RNA.

Here is a short list with the salient data of this company:

- Listing: NASDAQ (MRNA), Component of the NASDAQ-100

- Sector: Biotechnology industry

- Foundation: 2010

- Headquarters: Cambridge, Massachusetts USA

- Revenue: $ 60.2 million (2019)

- Employees: 820

Is buying Moderna shares worthwhile?

Moderna shares have been rising for several months and this is seen both as a very promising investment as well as a speculative “bubble” at risk of implosion.

As we will see better in the paragraph relating to analysts’ forecasts, the probabilities that it is a “bubble” are very low.

The momentum of the stock is due to the company’s growth prospects. The shares of large companies never seem cheap but by following this logic, you risk missing out on opportunities with very profitable potential.

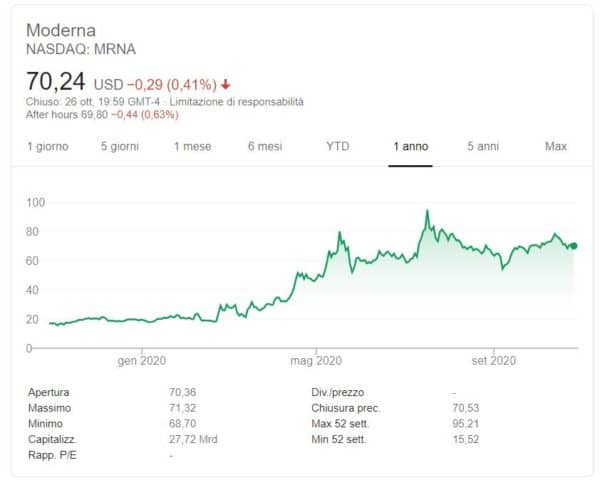

Moderna’s growth trend, which we see in the graph below, is most likely in its infancy and can offer excellent prospects both in the short as well as in the long term.

Modern stocks look expensive right now, like all rising stocks; however, Moderna may actually be underestimated relative to its potential which is tied to the coronavirus vaccine.

Remember that all valuation metrics used in the markets are based on past results, but it is also necessary to look to the future of a company to make profitable investments, otherwise you risk losing big opportunities.

Moderna’s competitors

Moderna’s major competitors are some of the largest pharmaceutical and biotech companies in the world. Here are the most important:

- Pfizer

- AstraZeneca

- Novartis

- Merck

- Illuminate

- Vertex

- Gilead

- Pharma Mar

Moderna shares: Forecasts

If we look at the profitability of Moderna, this is still disappointing. However, as we mentioned in the previous paragraphs, we must not remain too anchored to the evaluation metrics of “past events” but look at the future prospects.

This is why the analysts of the major international investment banks are almost all bullish on the Moderna stock. They are analyzing the company’s development possibilities, even if there are still few evaluation elements.

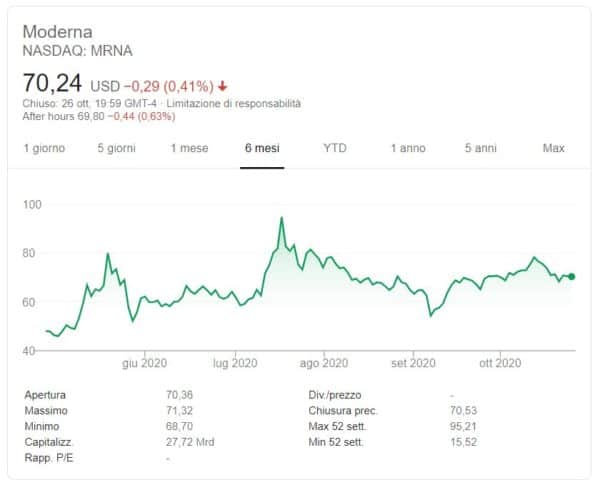

The chart below shows the lateral movement of the stock that has slowed its growth in recent months, but it is a momentary phase, or at least this is what the most renowned market analysts think:

Some companies are willing to postpone profitability and in this phase, Moderna is looking to grow rather than make profits, even if this is not very popular among shareholders, but is well seen by analysts.

Below, you can see some of the assessments of the major international investment banks, all of which agree on the future of this company:

- BidaskClub has increased Moderna’s shares from a “pending” rating to a “buy” rating.

- Jefferies Financial Group reaffirmed a “buy” rating and issued a $ 90.00 price target on Moderna stock.

- Chardan Capital lowered its Moderna share price target from $ 95.00 to $ 93.00 and set a “buy” rating on the stock.

- Needham & Company LLC has issued a “buy” rating and a $ 94.00 price target on the stock.

- Goldman Sachs Group has set a price target of $ 105.00 on Moderna’s stock and assigned the company a “buy” rating.

Moderna shares: Target price

Some of the leading international analysts have released valuations and price targets for Moderna. Their twelve-month average target price is $ 87.41, forecasting a 24.45% rise for the stock.

We looked at 17 international analysts and only 1 of them issued a sell rating. There are 2 suspension ratings and 14 chose a higher rating for the Moderna stock.

Conclusions

Evaluating such a “young” and promising stock is never easy, but in this guide we have examined the financial situation of the company and the growth forecasts estimated by the major international analysts.

This stock is suitable for short, medium, and long-term trading and currently offers a reasonable entry price for savvy speculators.

Market newbies should do some training with the free Demo account offered by the brokers we presented. After practicing, you will be able to make the minimum deposit required by the chosen Broker and seriously invest in the Moderna stock.

Here are the official links to access the Demo accounts of the best online brokers:

- Practice the eToro Demo account for free by clicking here

- Register for free on ForexTB and access the Demo account from this link

- Access the Trade.com Demo account for free from this link

According to the main international analysts, yes, it is worthwhile.

The forecasts are mainly positive, especially in the medium and long term.

The 12-month target price for the Moderna stock is $ 87.41 per share.

CFD brokers like eToro offer the safest and most reliable platforms to buy Moderna shares without paying commissions.