Buy Ping An Shares: [Read Here Before Investing]

The insurance sector is booming, especially in emerging countries and in those with an economy that is growing in double figures. Buying Ping An shares means betting on the largest insurance company in the world, but is it a good deal?

This guide will attempt to answer this question. In fact, we will describe in a precise and neutral way:

- The fundamentals of the company

- Growth and earnings

- How to invest in the stock

OnlineTradingCourse.net has selected the best brokers where to buy Ping An shares (or sell them short) without paying commissions. Here they are in a short list, in which emerges eToro, the market leader.

|

Platform: etoro Min. Deposit: 50€ License: Cysec |

|

|

|---|---|---|---|

|

Platform: xtb Min. Deposit: 100€ License: Cysec |

|

|

|

Platform: iqoption Min. Deposit: 50€ License: Cysec |

|

|

|

Platform: ubrokers Min. Deposit: 250€ License: Cysec |

|

|

|

Platform: trade Min. Deposit: 100€ License: Cysec |

|

72.30% of retail CFD accounts lose money

|

|

Platform: forextb Min. Deposit: 250€ License: Cysec |

|

|

Index

Ping An Shares: Real time quotation and price

Ping An: History

One of the most important holding companies in China deals with broad-spectrum financial services, serving both banks, companies, and individuals. Its name is Ping An Insurance also known as Ping An of China.

The foundation dates back to 1988 and the headquarters are in Shenzhen.

The meaning of the term “Ping An” in Chinese is “safe and sound”.

This insurance giant is in the 7th place of Forbes Global 2000 magazine and is considered the largest insurer in China, with $ 107 billion in gross premiums paid in 2018.

Its market capitalization is $ 220 billion (as of July 2019); a number that puts Ping An in the first place among the world’s insurance companies.

Ping An Insurance consistently ranks as the best global insurance brand and, in 2018, was the third most valuable financial brand ever.

How to buy Ping An shares

Now that we know what Ping An is, let’s try to understand how to buy its shares.

With a simple online broker, you can invest in this asset directly from your home with a PC.

What you need to pay attention to is the Broker you will choose to buy Ping An shares. They are not all the same; therefore, it is good that it has at least these 3 basic requirements:

- First, it must have at least one license issued by FCA or CySEC

- It must offer CFDs, contracts that allow you to invest both upwards and downwards (short selling).

- You don’t have to pay commissions.

In the next paragraph, we will help you choose the most suitable brokers for this investment.

Where to buy Ping An shares

The best way to choose a Broker is to test it. All the brokers presented at the beginning of this guide offer a totally free and risk-free Demo account.

Register, evaluate the trading platforms, the services offered. and the assistance provided. At that point you can make a comparison and choose the one that best suits your needs.

Too complicated?

Then you can simply trust the tests carried out by OnlineTradingCourse.net which found out the 3 best online brokers on the market: eToro, ForexTB and Trade.com.

Test the platforms of these brokers like this:

- Buy the Ping An CFDs to profit if the shares rise.

- Sell the Ping An CFDs to profit if the shares go down.

When the price reaches the desired target, close the transaction and collect any net profits, without paying commissions.

Here are the main features of the selected brokers:

eToro

eToro with its community of over 7 million active traders is the leader of the market.

The security of this intermediary also derives from its numerous licenses, such as that of FCA.

The most interesting feature of eToro is its platform, which is fast and intuitive like few others.

Below the Ping An stock:

To buy Ping An shares (or sell them), you have to click on “Invest”, decide whether to Buy or Sell the stock, and how much to invest in the operation.

Its fame comes not only from the intuitive platform but also from a revolutionary patent called Copy Trading.

This system allows you to copy the market transactions of the best investors in the world (chosen directly on eToro), in a fully automated manner and at no additional cost.

To use Copy Trading you have to follow these steps:

- Register on eToro

- In the section “people”, you can choose the traders to copy based on the performance.

- With a click, Copy Trading will copy exactly the same operations of the chosen traders in your account.

- At this point, you will get the same returns as these trading experts (of course, in proportion to your investment), without doing anything else.

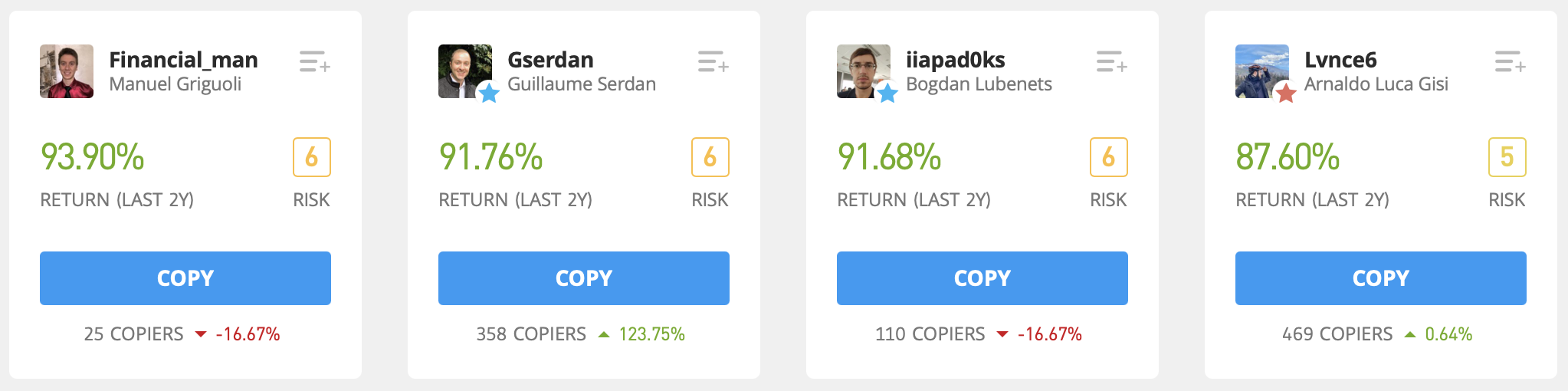

Here are some of the best eToro Traders (which can be copied):

Click here and choose which trader to follow

Both Copy Trading as well as traditional trading can also be tested on a free Demo account, without taking real risks.

Click here and sign up for free

For more details you can read our full eToro review.

ForexTB

ForexTB has achieved its current popularity thanks to a series of completely free services.

Clearly, this broker is also absolutely safe and can boast the authorization of the prestigious CySEC, valid throughout Europe and the UK.

ForexTB allows you to choose between 2 trading platforms, both free:

- The web platform is easy to use and can be entered from any browser without downloading any software.

- Metatrader 4 is more technical and full of professional indicators and meets the needs of the more experienced traders.

To buy Ping An shares (or sell them) simply click on Sell or Buy and decide how much money to invest in the operation.

ForexTB’s famous trading support is based on the Free Trading Signals which are sent to all investors. These indications are very precise and are successful 70% of the time, an excellent support for online trading.

Click here and download the trading course for free

ForexTB tries to help above all novice traders and for this reason, it has created for free a Trading Course considered among the best in its category. This ebook summarizes the basics of online trading and allows you to learn technical analysis in a simple way and with practical examples.

Click here and download the trading course for free

Trade.com

Trade.com notoriety has spread incredibly thanks to its very professional platform and to the entry threshold.

The minimum deposit required by Trade.com to open a real account is in fact only 100 Euros, much lower than the average on the market.

The security of this intermediary is guaranteed by FCA.

In the screenshot below, you can see the Ping An CFDs:

To buy (or sell) Ping An shares, just click on Buy or Sell and decide how much to invest.

Click here to sign up for free

Trade.com relies heavily on training, which is necessary to improve the performance of its users. The notions of technical analysis are the basis of a good profit in trading and this Broker has created a very complete trading course, a pdf that can be downloaded for free using the link below:

Download the free Trade.com course by clicking here

To open a real account with Trade.com you need at least 100 Euros, an amount lower than the average. However, to get started there is always the totally free and unlimited Demo account.

Click here to sign up for free

Ping An business model

The business model of Ping An Insurance (Group) Company of China, Ltd. is based on providing financial products and services for insurance, banking, asset management, fintech, and healthtech in China.

The company’s Life and Health Insurance segment offers term, life, annuity, investment-related, universal, and health and medical care insurance to individual and corporate clients.

The company is listed on the Shanghai and Hong Kong stock exchanges. It is part of the CSI 300, the FTSE China A50, and the Hang Seng index, one of the major stock indices on the Asian continent.

The salient numbers of Ping An are:

- Quotation: SSE (601318), SEHK (2318)

- Sector: Financial Services

- Foundation: 1988

- Founder: Ma Mingzhe

- Headquarters: Shenzhen, China

- Revenue: CN ¥ 683.2 billion (2020)

- Net profit: CN ¥ 68.6 billion (2020)

- Number of employees: Approx. 190,000

Is buying Ping An shares worth it?

It is not at all easy to answer this question; even the major analysts are undecided on the short-term future of this asset.

In the long term, however, it is easier to predict growth for the Ping An stock, accompanied by the constant development of the Chinese market.

We try to evaluate the numbers that characterize the financial situation of the company:

- Ping An’s customers reached 214 million in September 2020, up by 7% from January.

- In the first nine months of 2020, Ping An’s life and health insurance business, its main profit driver, generated 75.45 million yuan of operating profit, up by 9.2% year-on-year.

- However, its net profit, in these nine months, has dropped by 20.9% as Covid-19 negatively impacted its long-term protection business.

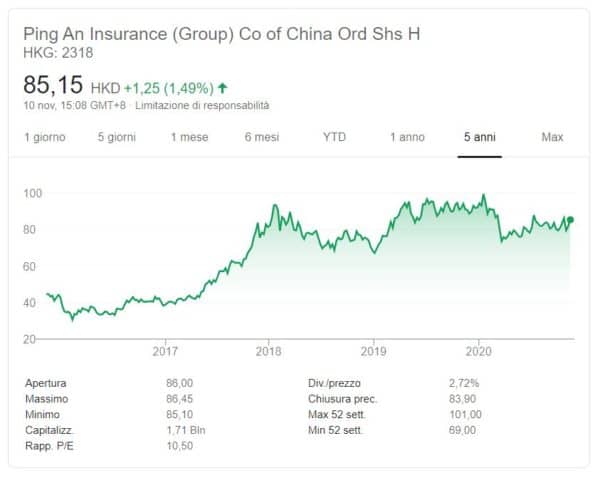

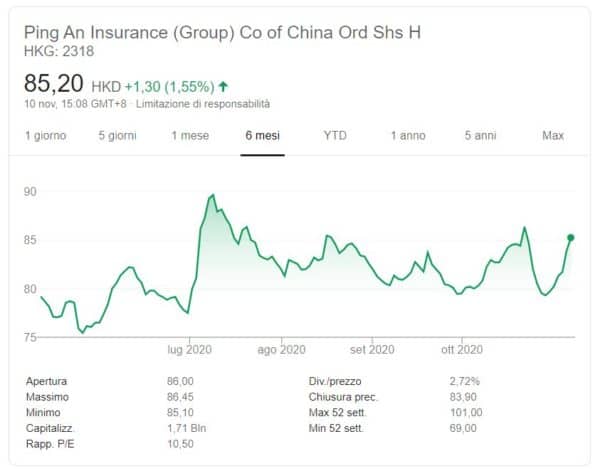

If we look at the performance of the Ping An stock over the past 5 years, we have seen stagnation since 2018, but the response to the global pandemic has been good overall.

Analysts believe that in the short term, the demand for insurance will be even weaker than before the epidemic, but will gradually tend to recover over the course of 2021.

Ping An competitors

The major competitors of Ping An are some of the largest insurance companies in the world; the main ones are listed below:

- China life

- MetLife

- Prudential

- Allianz

- Axa

Ping An shares: forecasts

Recently the numbers of Ping An are recovering and bode well for the future. Ping An Insurance Group recorded a 6.1% increase in net profit in the third quarter of this year.

The company it has become the largest shareholder of British bank HSBC Holdings, with an 8% stake.

The performance of the Ping An stock in recent months has been very fluctuating. The uncertainty of the market is still high and the short-term forecasts are mixed.

Goldman Sachs analysts have set a “buy” rating on the stock but the time horizon is quite long.

The short term is the territory of those who aim for “trend following” strategies, such as Intraday Trading or Scalping. In the long term, however, you can make really interesting profits, but you have to be patient.

Buying Ping An shares can be part of a strategy that involves building a portfolio of securities in the banking / insurance sector, which is gradually set to recover in the near future.

Ping An shares: Target price

The main international analysts are not unanimous in assessing the growth of Ping An in the short term. However, in the long term, a return to the levels of early 2020 is expected.

The 12-month target price for Ping An is 92.45 HKD.

Conclusions

The financial situation of this Chinese insurance giant is solid, many of the benchmarks have remained growing despite the crisis, but confidence in the sector is still weak.

As we have seen, the growth prospects for this stock are good but it is necessary to wait patiently; it can take several months before we see Ping An shares back at pre-Covid levels.

If you like banking / insurance or Chinese stocks, buying Ping An shares in a long-term perspective can be a really profitable investment, especially if within a well-balanced portfolio.

Are you a novice trader?

Then we give you some advice, follow these steps:

- Sign up for free to the 3 brokers we have reviewed

- Start using the Demo accounts, without making any deposits

- Evaluate the platforms by investing (in Demo) on the Ping An stock

- Choose the Broker that best suits your trading style!

Here are the official links to access the Demo accounts of the best online brokers for free:

- Practice the eToro Demo account for free by clicking here

- Register for free on ForexTB and access the Demo account from this link

- Access the Trade.com Demo account for free from this link

Ping An is the largest insurance group in the world.

In a long-term perspective, analysts are oriented towards buying, but in the short term the situation is still uncertain.

The 12-month target price for the Ping An stock is 92.45 HKD

Online brokers like eToro are the perfect choice to invest in this stock without paying commissions.