Buy Rivian Shares: Forecast and Target Price

The world of electric cars has a new protagonist who has focused on pick-ups and light vans to attack the American market and beyond. Amazon and Ford’s participation in the project is pushing many investors to buy Rivian shares, which went public on November 10, 2021.

The market capitalization achieved is already very respectable and orders are already important, especially those coming from the e-commerce giant Amazon, which will use those vehicles for deliveries.

In this guide we will evaluate:

- Economic situation of the former start-up

- Market and competitors

- Analyst forecasts

Here is a diagram highlighting the relevant data of this automotive company:

| Listing | 👜 New York Stock Exchange |

| ISIN | 📌 US76954A1034 |

| Benchmark | 📃 NASDAQ |

| Established | 📅 2009 |

| Sector | 🧪 Electric Vehicles |

| Ticker | 🏷️ RIVN |

| Turnover | 💰 n.d. |

| Best Platforms | 📈eToro / Trade.com |

To buy Rivian shares you need a broker, so here is a short list of the best online trading platforms on the market:

|

Platform: etoro Min. Deposit: 50€ License: Cysec |

|

|

|---|---|---|---|

|

Platform: xtb Min. Deposit: 100€ License: Cysec |

|

|

|

Platform: iqoption Min. Deposit: 50€ License: Cysec |

|

|

|

Platform: ubrokers Min. Deposit: 250€ License: Cysec |

|

|

|

Platform: trade Min. Deposit: 100€ License: Cysec |

|

72.30% of retail CFD accounts lose money

|

|

Platform: forextb Min. Deposit: 250€ License: Cysec |

|

|

Index

IPO Rivian

Rivian Automotive is a manufacturer of electric pickups, SUVs and vans with 20% stake by Amazon (which ordered 100,000 of those vans two years ago) and 13% by Ford.

The IPO on November 10, 2021 was a success. On the first day of trading, the stock jumped 38% to 106 dollars, and 93 billion dollars in capitalization, more than GM and Ford and much more than other big historical names such as BMW, Stellantis or Ferrari; but also well ahead of the three Chinese electric startups Nio, Xpeng and Li Auto.

The American company is based in California and was founded in 2009 by Robert “RJ” Scaringe with the name of Mainstream Motors first, then Avera Automotive and finally Rivian.

The company’s core business is the creation of light work vehicles such as vans and pick-ups but also SUVs and other vehicles on the same platform.

The company also plans to build an exclusive charging network in the United States and Canada to help spread its vehicles.

How to Buy Rivian Shares

To buy Rivian shares, now that the company is listed on the stock exchange, you can choose between two types of intermediaries:

- Traditional brokers, which provide for the opening of a securities account, the payment of stamp duty and trading commissions.

- CFD Brokers, who offer Contracts for Difference, do not need a securities account and offer very favorable conditions.

The choice depends on your trading strategy, the capital you have available, the frequency of your trades, etc.

Generally speaking, if you have substantial capital and want to make a long-term investment, buying Rivian shares and holding them for months or years, traditional brokers can be fine, despite being more expensive.

If, on the other hand, you want to do short-term online trading, trading the Rivian stock according to its fluctuations, looking for frequent small profits, CFD brokers are certainly more suitable.

Here are the main advantages offered by Contracts for Difference and related brokers:

- They allow you to Short Sell

- The initial deposit is low

- Even small investments can be made

- The trading platforms are very intuitive

- There is a Demo account to practice

Where to Buy Rivian Shares

To choose a trading broker you must first check that it has at least a license.

Security is essential in the world of financial investments and a license issued by an entity such as CONSOB or CySEC is essential if you want to avoid scams.

The brokers proposed in this guide are obviously all regulated and provided with regular licenses, so your choice is totally free.

In the following paragraphs you will find descriptions of the 2 best brokers to buy Rivian shares, start by evaluating their characteristics:

eToro

eToro is one of the most popular online brokers in Europe and other territories. It can count on over 20 million users registered on its platform which confirm its high level of reliability.

This platform has made a difference and made this broker unique and difficult to overcome.

On eToro you can trade directly in shares, with direct access to the market (DMA), or CFDs, which offer you numerous financial options such as indices, commodities, currencies and cryptocurrencies.

Here’s what the Rivian stock looks like on the eToro platform:

How do you buy Rivian shares with eToro?

- Register on eToro

- Log into your real account (by depositing at least € 50)

- Select the Rivian stock and click on “Trade”

- Decide whether to buy or sell the shares and how much to bet in the operation

If you want to take advantage of the skills of the best traders who use this Broker, you can take advantage of Copy Trading. A service that allows you to copy the market operations of the traders chosen by you on the eToro platform, based on your evaluation parameters.

Thanks to this patented system, you will get the same results (based on how much you have invested) of the traders you have decided to copy.

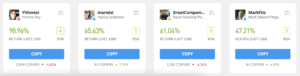

Here are some examples of traders with their return rates:

Past performance is no guarantee of future returns.

Click here and choose which traders to copyTrade.com

Trade.com is a financial intermediary that has been able to create a solid base of users who are very fond of this Broker.

Quality combined with safety have allowed Trade.com to obtain a CONSOB and CySec license, which is extremely popular in Europe.

The availability of securities and assets is very wide and always up-to-date. You can trade in stocks, commodities, indices, cryptocurrencies, forex, etc. always without paying trading commissions thanks to CFDs.

But that’s not enough, Trade.com also cares about the training of its members and has decided to support their progress with a free Trading Course.

The success of this ebook, which lays the foundations of technical analysis without exceeding technicalities, has led the Broker to make it available to everyone, even to those who are not Trade.com customers

In fact, just use the link below to download the Trading Course for free:

Download the Trading Course for free by clicking hereTrade.com offers its members two trading platforms: MetaTrader 4 and the Web Platform.

To buy Rivian shares on Trade.com you need to follow these simple guidelines:

- Register for free on Trade.com

- Log into your real account by depositing at least € 100

- Select the Rivian stock and click “Buy” to buy or “Sell” to short sell

- Decide how much to invest in the operation

Rivian Shares NASDAQ

As Rivian is a new publicly traded company, it is not easy to predict its share price.

The NASDAQ listing of the New York Stock Exchange is recent and the chart below does not show a clear trend of the stock, at least for the moment:

Rivian Business Model

Rivian’s business model is that of an automobile manufacturer that designs, manufactures and sells electric vehicles, particularly SUVs, vans and pickups.

Rivian uses a single platform that will also be able to support other vehicles in the future and also be used by other manufacturers.

In addition to these vehicles, the company also manufactures semi-autonomous vehicles and batteries.

Some relevant data from Rivian:

- Quotation: Nasdaq (RIVN)

- Sector: Electric cars

- Foundation: 2009

- Founder: Robert “RJ” Scaringe

- Headquarters: Irvine, California, USA

- CEO: RJ Scaringe

- Employees 9,000

Is it worth to Buy Rivian Shares?

The RIVN stock reached a closing high of $ 172 on November 16, after closing at $ 100 on the very day of the IPO (six days earlier). Since then, the share price has fallen and this was to be expected given the somewhat abrupt departure.

But what we need to seriously consider in deciding whether to buy Rivian stock is the interest of the company’s supporters.

Financial support from Amazon and Ford provides a stable foundation that strengthens this company’s future. Electric vehicles are expanding and the demand is huge. Furthermore, analysts review Tesla’s beginnings in this company …

We cannot say that the future of the share price will follow the fate of the company founded by Elon Musk, but the volatility is high and certainly represents a stock to be followed carefully.

Rivian Shares ISIN

Rivian’s ISIN code, in its listing on the New York Stock Exchange, is US76954A1034.

Rivian Competitors

Major mainstream automakers including Toyota and Volkswagen all have an edge over Rivian in terms of market capitalization, at least for now. But this innovative company has entered the market by force and competes with the major companies in the sector, such as:

- Tesla

- Lucid Motors

- Canoo

- Nikola

- Foxconn

- Kodiak

- Lordstown

- Faraday Future

- Uniti

- Rimac

- Nio

- Xpeng

- Li Auto

- BYD

- CATL

Rivian Shares Forum

In forums dealing with Rivian stocks there is a lot of talk about the actual production and capabilities of the means this industry is building.

The Californian company has finally started deliveries of the long-awaited all-electric R1T pickup. Rivian is the first to bring an all-electric pickup to market, which has an estimated range of 314 miles (505 km) and can also tow up to 11,000 pounds (nearly 5 tons).

For light work vehicles such as vans and pick-ups, towing capacity is essential, because they will often have to travel with considerable loads and this can significantly change the range.

During testing, the owners of the R1T showed that with 37% remaining battery they only had 44 miles (70km) of electric range. This would mean a total autonomy much lower than the declared one.

Unfortunately, the limitations of the network of electricity columns hinder a lot the spread of these means, which does not

Rivian Shares Forecast

When RIVN stock hit $ 172, the company’s capitalization touched $ 150 billion, placing it in third place among all vehicle manufacturers, behind only Volkswagen and Tesla.

These numbers should not confuse ideas, what matters now and how much of what the company has promised it will be able to achieve and in how much time.

Still many analysts have not shown their estimates and investors are waiting for some more precise predictions before buying Rivian stock, but the excitement is palpable.

The volatility and fluctuations of the stock, which you can also see in the graph below, attract mainly those who do Day Trading or Swing Trading, while long-term investors are still hesitant.

Although some experts consider Rivian to be an example of Growth Investing, it must be borne in mind that the investment banks that have invested in this stock are many, here are the most important:

Morgan Stanley, Goldman Sachs, JP Morgan, Barclays, Deutsche Bank, Wells Fargo, Piper Sandler, RBC, Baird, Wedbush, Loop Capital and many more.

Rivian Target Price

Despite the limited information available on the stock and its short history on the NASDAQ, we can provide an average price target for the RIVN stock, based on the most recent forecasts.

The 12-month average target price for Rivian is $ 129.95 per share.

Conclusions

Rivian’s IPO rocked the NASDAQ making this title one of the biggest hits of the past 10 years on Wall Street.

The company is well supported and is aiming at a market, that of light electric vans, which is still almost virgin.

Analysts believe that accurate long-term predictions cannot be made at the moment due to the lack of historical data, but this stock is perfect for short-term trading.

The CFD brokers that we have proposed are the ideal solution for this kind of high frequency investments: They are reliable, cheap and simple to use.

Here are the links to test your best strategy in Demo, without risking money:

- Access the eToro Demo account by clicking here

- Register on Trade.com and try the Demo account by clicking here

Rivian went public on November 10, 2021

Rivian’s ISIN code, in its listing on the New York Stock Exchange, is US76954A1034.

The 12-month average target price for Rivian is $ 129.95 per share.

With eToro, a reliable broker that allows you to buy shares directly or trade them through CFDs.