Buy Zoom Shares: [The Complete Guide]

Smart working and the pandemic that characterized 2020 have forever changed the way we communicate at a corporate and personal level and Zoom has benefited greatly from all of this. But is buying Zoom shares still convenient or is the stock now overvalued?

To answer this question we will evaluate the economic situation of this company and the performance of the stock. We will also provide you with forecasts made by the leading market analysts, in order to give you some short and long term indications.

We will also highlight the steps necessary to invest in assets, which we can summarize in 3 steps:

- Choose a CFD Broker that offers a safe and intuitive platform.

- Practice on the Demo account to practice without taking risks.

- Make a small deposit to invest on the real market.

OnlineTradingCourse.net has selected the best platforms to buy AMD shares without paying commissions, one of which is offered by eToro, the market leader.

|

Platform: etoro Min. Deposit: 50€ License: Cysec |

|

|

|---|---|---|---|

|

Platform: xtb Min. Deposit: 100€ License: Cysec |

|

|

|

Platform: iqoption Min. Deposit: 50€ License: Cysec |

|

|

|

Platform: ubrokers Min. Deposit: 250€ License: Cysec |

|

|

|

Platform: trade Min. Deposit: 100€ License: Cysec |

|

72.30% of retail CFD accounts lose money

|

|

Platform: forextb Min. Deposit: 250€ License: Cysec |

|

|

Index

Buy Zoom shares: Real-time quotation and price

Zoom: History

Zoom Video Communications, Inc. or simply Zoom, is an American company based in California.

The company was founded by Eric Yuan, a former Cisco engineer and executive, who launched software for high-quality, low-bandwidth video calling and conferencing.

The development of technology and the growth in the use of its services, led Zoom to reach a billion valuation already in 2017, making it a “unicorn” company.

Profits came just 2 years later when it went public on the New York Stock Exchange and entered the NASDAQ index in the spring of 2020.

How to buy Zoom shares

Zoom is part of one of the most famous stock market indices in the world and is listed in the United States, but this does not make it difficult to buy Zoom shares, which can be done directly online, just using a PC and a CFD Broker.

Brokers are obviously not all the same and attention must be put while choosing the right intermediary.

As a rule, the inevitable requirements that a Broker must possess are:

- It must offer CFDs, contracts for difference, that allow you to invest both up and down (short selling).

- You don’t have to pay commissions.

- It must have the authorization of at least one supervisory body such as FCA or CySEC.

To buy Zoom shares (or sell them) on one of the trading platforms offered by these online brokers you must:

- Buy the Zoom CFDs to earn if the shares go up.

- Sell the Zoom CFDs to earn if the shares go down.

When the stock reaches the expected price, the transaction can be closed and any net profits collected, without paying commissions.

Where to buy Zoom shares

Now that we know how to buy Zoom shares, we have to choose which broker to use. But how do you do it?

The best way is to test the best trading platforms, evaluate the services they offer, and make a comparison.

OnlineTradingCourse.net has already done these tests for you and it had concluded that the best CFD brokers where to buy AMD shares safely are: eToro, ForexTB and Trade.com.

The final choice is still up to you: Register, try their respective Demo accounts, and choose the one you prefer.

eToro: Buy Zoom shares with an intuitive platform

eToro with its community of over 7 million active traders is the leader of the market.

The security of this intermediary also derives from its numerous licenses, such as that of FCA.

The most interesting feature of eToro is its platform, which is fast and intuitive like few others.

Below the Zoom stock:

To buy Zoom shares (or sell them), you have to click on “Invest”, decide whether to Buy or Sell the stock, and how much to invest in the operation.

Its fame comes not only from the intuitive platform but also from a revolutionary patent called Copy Trading.

This system allows you to copy the market transactions of the best investors in the world (chosen directly on eToro), in a fully automated manner and at no additional cost.

To use Copy Trading you have to follow these steps:

- Register on eToro

- In the section “people”, you can choose the traders to copy based on the performance.

- With a click, Copy Trading will copy exactly the same operations of the chosen traders in your account.

- At this point, you will get the same returns as these trading experts (of course, in proportion to your investment), without doing anything else.

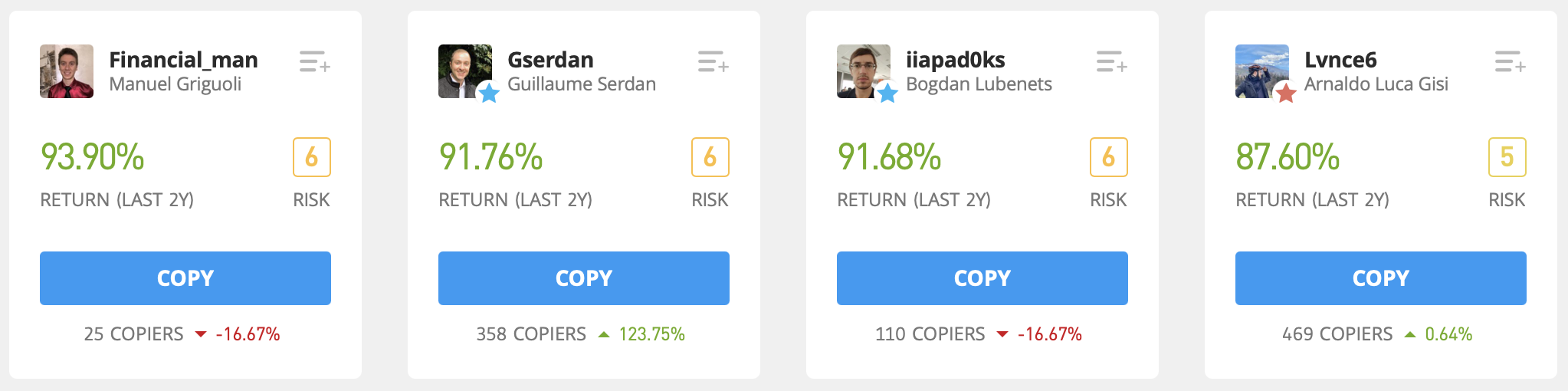

Here are some of the best eToro Traders (which can be copied):

Click here and choose which trader to follow

Both Copy Trading as well as traditional trading can also be tested on a free Demo account, without taking real risks.

Click here and sign up for free

For more details you can read our full eToro review.

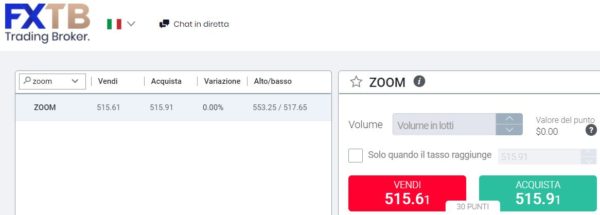

ForexTB: Buy Zoom shares thanks to the Trading Signals

ForexTB has achieved its current popularity thanks to a series of completely free services.

Clearly, this broker is also absolutely safe and can boast the authorization of the prestigious CySEC, valid throughout Europe and the UK.

ForexTB allows you to choose between 2 trading platforms, both free:

- The web platform is easy to use and can be entered from any browser without downloading any software.

- Metatrader 4 is more technical and full of professional indicators and meets the needs of the more experienced traders.

To buy Zoom shares (or sell them) simply click on Sell or Buy and decide how much money to invest in the operation.

ForexTB’s famous trading support is based on the Free Trading Signals which are sent to all investors. These indications are very precise and are successful 70% of the time, an excellent support for online trading.

Click here and download the trading course for free

ForexTB tries to help above all novice traders and for this reason, it has created for free a Trading Course considered among the best in its category. This ebook summarizes the basics of online trading and allows you to learn technical analysis in a simple way and with practical examples.

Click here and download the trading course for free

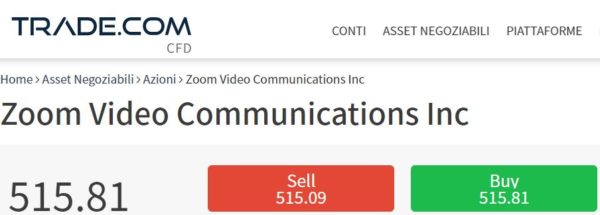

Trade.com: Buy Zoom shares with 100€ deposit

Trade.com notoriety has spread incredibly thanks to its very professional platform and to the entry threshold.

The minimum deposit required by Trade.com to open a real account is in fact only 100 Euros, much lower than the average on the market.

The security of this intermediary is guaranteed by FCA.

In the screenshot below, you can see the Zoom CFDs:

To buy (or sell) AMD shares, just click on Buy or Sell and decide how much to invest.

Click here to sign up for free

Trade.com relies heavily on training, which is necessary to improve the performance of its users. The notions of technical analysis are the basis of a good profit in trading and this Broker has created a very complete trading course, a pdf that can be downloaded for free using the link below:

Download the free Trade.com course by clicking here

To open a real account with Trade.com you need at least 100 Euros, an amount lower than the average. However, to get started there is always the totally free and unlimited Demo account.

Click here to sign up for free

Zoom: Business model

Zoom Video Communications, Inc. provides a premier video communications platform for the whole world.

The business model is divided into: Zoom Meetings, which offers HD video, voice, chat, and content sharing via PC and smartphone; Zoom Phone, a corporate cloud phone system; and Zoom Chat, which allows the sharing of messages, images, audio files, and contents on PC and smartphone.

Some useful data from Zoom Video Communications:

- Quotation: NASDAQ (ZM)

- Index: NASDAQ-100

- Established: 2011

- Headquarters: San Jose, California, United States

- Founder: Eric Yuan

- Sector: Communications

- Revenue: $ 622 million (2019)

- Net profit: $ 21 million (2019)

- Employees: 2,532

Is buying Zoom shares worth it?

The global pandemic is changing the way people work and communicate and videoconferencing, videochat, and video calling services are more in demand.

These changes will also leave their mark in the future and this should confirm the hypothesis that buying Zoom shares is convenient.

But there is also a limit beyond which even a stock like Zoom becomes “overbought”.

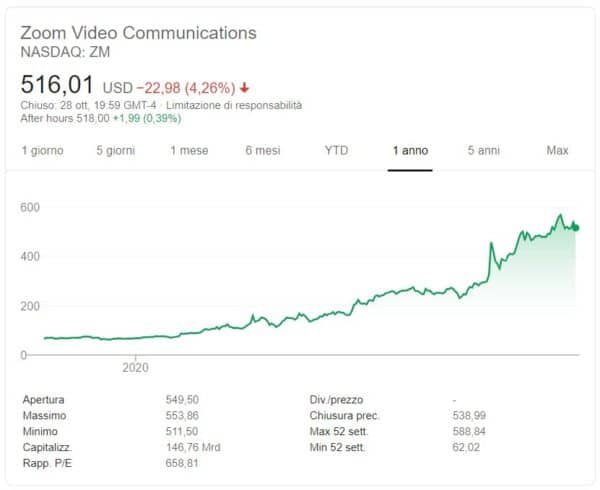

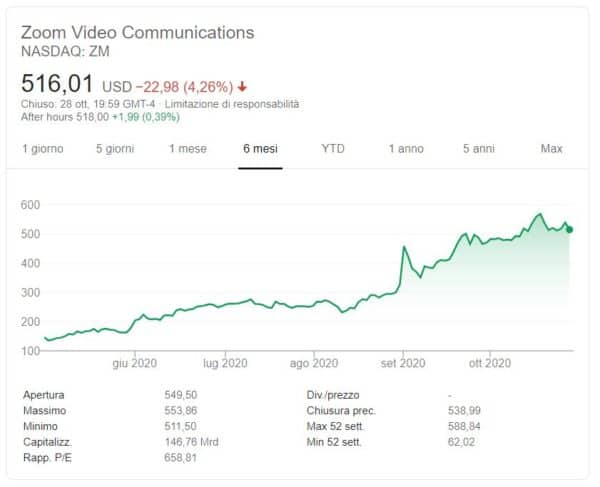

Zoom shares have grown tremendously in 2020, up by 750% since the beginning of the year.

The graph below clearly shows this growth. At this point analysts are wondering if such a strong trend is sustainable for a long time.

The aftermath of the coronavirus pandemic will change the way we work and communicate forever, but will the use of Zoom continue to grow or has it already peaked?

Zoom’ competitors

Competitors also affect the Zoom share price and the giants we see below did not stand by while this rookie gnawed on important slices of the market.

- Microsoft

- Tencent

- Apple

Zoom forecast

Economic uncertainty and market volatility are an advantage for the Zoom stock, which offers very interesting profit opportunities.

Short-term traders, those who do Scalping or Day Trading, will be able to take advantage of the fluctuations of this stock, even if it should lose value.

Remember that with CFD Brokers you can invest both up and down (short selling) and make profits whatever the direction of the trend. The important thing is to make the correct forecast.

Major international merchant banks have differing views on this stock. For some, buying Zoom shares is still a good investment, while for others the price has now peaked and does not reflect the real value of the company, as a consequence, it is destined to fall.

Here are the forecasts of some of these renowned analysts, so you can get an idea of the uncertainty that reigns in the markets:

- Bank of America raised its price target from $ 475.00 to $ 570.00 for Zoom Video Communications, moving to a “buy” rating on the stock.

- KeyCorp has reaffirmed a “buy” rating on Zoom Video Communications shares.

- Credit Suisse Group increased its share price target for Zoom Video Communications from $ 160.00 to $ 315.00 and assigned the stock an “underperformance” rating.

- Sanford C. Bernstein raised Zoom Video Communications’ target share price from $ 228.00 to $ 611.00 and gave the company an “outperformance” rating.

- CFRA has issued a “for sale” valuation and a target price of $ 215.00 for the company.

- Morgan Stanley raised its price target on Zoom Video Communications from $ 240.00 to $ 350.00 and gave the stock an “equal weight” rating.

Zoom Shares: Target price

Analysts from major investment banks have published valuations and pricing targets for Zoom Video Communications. Their twelve-month average target price is $ 413.21, expecting the stock to decline by 19.92% within one year.

Of the 27 forecasts we looked at, there are 2 sell ratings, 11 pending ratings, and 14 buy ratings for the stock.

Conclusions

Zoom shares are still being driven by a strong bullish trend, but it is a suitable stock for short-term investments and for many analysts it could soon collapse.

Thanks to the CFD Brokers that we have presented in this guide, you now know that you can buy Zoom shares or sell them short depending on the direction of the stock and profit from any market conditions.

If you have little trading experience you should do some tests on the free Demo account offered by the best online brokers. After practicing, you can make the minimum deposit required by the chosen Broker and seriously invest in the Zoom stock.

Here are the official links to access the Demo accounts of the best online brokers:

- Practice the eToro Demo account for free by clicking here

- Register for free on ForexTB and access the Demo account from this link

- Access the Trade.com Demo account for free from this link

In the short term it may still be worthwhile but the trend could reverse.

For some analysts, yes, in fact there are investors who are already bearish on the stock.

The 12-month target price for the Zoom stock is $ 413.21 per share.

A CFD Broker like eToro is sufficient, which offers the possibility to invest both up and down safely and without paying commissions.