Cryptocurrency Exchange or CFD Broker: what to choose

Are you interested in trading cryptocurrencies? Then it is very likely that you have already asked yourself what is the best place to trade. There are basically two choices available to you: a Cryptocurrency Exchange or a good CFD Broker.

Well, as you may already know – especially if you have carefully read the many insights we have dedicated to this topic – the two options are very different from each other, and what might be best for one trader … might not be for another.

By understanding what the differences are between the two options, however, you can easily make a more informed decision when you start trading cryptocurrencies.

In this guide to cryptocurrency exchanges you will find:

- The main differences between the two alternatives

- The advantages of both

- The best investment platforms available today

We will then analyze the best alternatives to exchanges, explaining why relying on them could be the right choice. An example? With eToro Copy Trading you can successfully invest in cryptocurrencies even without having any skills.

So let’s start our analysis to try to understand more.

|

Platform: etoro Min. Deposit: 50€ License: Cysec |

|

|

|---|---|---|---|

|

Platform: xtb Min. Deposit: 100€ License: Cysec |

|

|

|

Platform: iqoption Min. Deposit: 50€ License: Cysec |

|

|

|

Platform: ubrokers Min. Deposit: 250€ License: Cysec |

|

|

|

Platform: trade Min. Deposit: 100€ License: Cysec |

|

72.30% of retail CFD accounts lose money

|

|

Platform: forextb Min. Deposit: 250€ License: Cysec |

|

|

Index

What is a Cryptocurrency Exchange

Before starting the comparison, let’s clarify the subject of our analysis. A cryptocurrency exchange is a platform that allows you to exchange cryptocurrencies with each other or with fiat currency.

Cryptocurrencies are financial instruments that have been enjoying growing success in recent years, thanks to remarkable returns that have attracted the interest of numerous investors, including novices.

We are not just talking about Bitcoin but also about other cryptocurrencies: let’s think of Ethereum, to name one of the most famous alternatives, but the digital market is full of hundreds of options. These are available for trading on exchanges, which are the place of exchange where ambitious traders go every day to buy (or sell) cryptocurrencies, hoping to make a noteworthy profit tomorrow.

Among the most famous names we remember Coinbase, Kraken and Binance (with its Binance Coin), which offer good quality services, supported however by numerous operators whose reliability is to be verified.

Cryptocurrency Exchange vs. CFD Broker

Let’s now examine the main criteria that will allow us to determine which of the two alternatives is the best for investing in cryptocurrencies.

Possession of the asset

The first element of difference is related to the ownership of the asset.

If you want to “physically” own the cryptocurrency, then an exchange is for you. However, it must be said that if you try to own the cryptocurrency, you’d better never leave it on the exchange but you should rather proceed to withdraw it in a secure wallet, possibly offline.

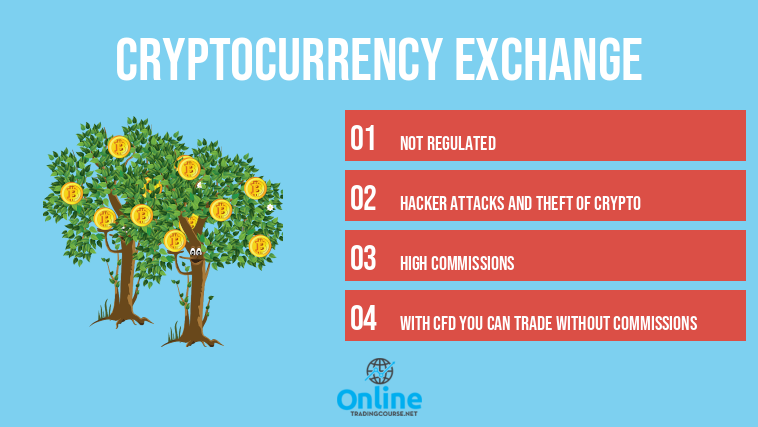

We would like to share this advice with you because cryptocurrency exchanges have a history of violations and hacker attacks that is certainly not favorable and therefore even your cryptocurrency can be stolen. Better to put the tokens in a wallet that only you can be sure of accessing.

CFDs are very different. CFD stands for ‘Contract for Difference‘ and it is … what you are technically trading! The CFD is basically an agreement between you and the broker to buy the underlying asset at a certain price. In this case, a cryptocurrency.

Now, through a CFD you will never be able to “physically” own the cryptocurrency. And this should be a potential “advantage”! In fact, you will never be exposed to the fact that things go wrong, such as the theft of digital currency.

In short, a nice advantage for those who choose to trade with CFDs, also in the knowledge that:

- There is always the hassle of learning and securely storing the keys to your cryptocurrency wallet

- Cryptocurrency exchanges and wallets can be difficult to use compared to the trading platforms of CFD brokers

Regulation of Cryptocurrency Exchange and CFD Brokers

This is perhaps one of the biggest problems when it comes to trading on a cryptocurrency exchange, rather than a CFD broker.

As you probably already know, regulation in the cryptocurrency industry has not yet reached an expected level of maturity. And regulation in most countries is still in the pipeline, or is ambiguous.

For this reason, most cryptocurrency exchanges are not regulated by any regulatory body, as is the case with CFD brokers, which must be strictly regulated by the financial authorities of the areas in which they operate (for example, in Europe, Consob or CySec). They are therefore much safer, for this reason.

For example, in order to be licensed to operate in the European market, CFD brokers must demonstrate that they know how to separate their funds from those of their clients, which must be deposited in current accounts of the main international banks.

We cannot say that exchanges are real scams like Bitcoin System (although there are cases of scams) but neither are they as reliable as CFD brokers.

Trading times

Most cryptocurrency exchanges are open all day, every day. However, it is certainly not an exclusive feature of exchanges: even CFD brokers can be used whenever you want!

Clearly, having a platform that is always accessible offers greater availability. If something important happens outside of normal trading hours, you might in fact take advantage of it.

Trading Platforms

With a CFD broker you will certainly have a great selection of platforms to trade with and a much wider choice of technical indicators to use.

Cryptocurrency exchanges, on the other hand, tend to be much more limited in what they can offer traders in terms of platforms and useful tools and indicators to improve the effectiveness of their trade.

For example, exchange software may lack standard tools such as stop-loss orders and take profit orders, which are vital when trading cryptocurrency, where strong price swings regularly occur.

Speed

CFD brokers are on average much faster to conduct buy or sell trades, as you never own the underlying!

When trading with a cryptocurrency exchange, however, the process takes longer as the transaction must be placed in the blockchain and verified, but what is the problem?

Is simple! When you finally manage to buy cryptocurrency or sell it, you may have concluded the transaction at a different price than what you wanted, for better or for worse. In the worst case, therefore, you may even have lost money.

Of course, this is no small detail! Accuracy is indeed vital to achieving your trading goals.

Leverage

Most CFD brokers offer leverage to be able to invest in cryptocurrencies, while this feature is by no means guaranteed by digital currency exchanges. Furthermore, CFD brokers usually offer much higher leverage than exchanges, for professional traders.

That said, CFD traders should be very cautious when applying leverage. Ideally, only very experienced traders should use it! In our case, however, we recommend using financial leverage only after having used a demo account for a long time, such as the one you find on the eToro website or on the Trade.com website, which can be opened for free.

Choice

Cryptocurrency exchanges typically offer a very large selection of cryptocurrencies to trade. But it’s worth asking yourself if you really need a selection of thousands of digital currencies to trade?

Most of the cryptocurrencies you end up finding on exchanges will appear as unknown to you, and you probably won’t be able to tell what their value is.

In short, it is highly likely that you will limit yourself to trading with only a handful of the most well-known digital currencies that you will probably find with a normal CFD broker.

However, perhaps the most important thing to note is another. By trading with a CFD broker, in fact, you will not be limited only to investments in cryptocurrency, but you will also be able to trade stocks, forex, commodities and much more.

The above will allow you to diversify your portfolio and reduce risk when the cryptocurrency market is down.

Spread and Commissions of Cryptocurrency Exchange and CFD Broker

CFD brokers often have increasingly competitive spreads on cryptocurrency trading. However, it is also necessary to take into account the commissions that exchanges apply and that CFD brokers do not normally apply, since their remuneration is determined exclusively by the above spread.

Of course, the fee can become problematic for CFD traders, even in the long term, as is the swap fee, which is applied for overnight positions (i.e., if you hold a position overnight).

In any case, whatever option you choose, you need to be aware of the different fees and expenses that may be charged in addition to your operations.

Prices

Both CFD brokers and cryptocurrency exchanges can be subject to incorrect prices, cryptocurrency quotes are not always the same.

CFD brokers can, for example, be market makers, or represent the “place” in which the market is “made”, and therefore prices are formed independently, which could be different from those that are in force at other brokers or at other exchanges .

Therefore, to trade in real market conditions, CFD traders should look for ECN, STP or DMA brokers. However, even this is not a solution that seems to be optimizing, given that access to these operators is more complicated and more expensive.

Cryptocurrency exchanges are also “susceptible” to “artificial” prices: even in this case, however, they can differ significantly from one operator to another.

Customer care

A very important difference between CFD brokers and cryptocurrency exchanges is also that CFD brokers have been around for much longer. Conversely, cryptocurrency exchanges have existed for a few years at most.

This feature is also reflected in customer service. CFD brokers tend to offer better customer service than cryptocurrency exchanges.

In short, with a cryptocurrency exchange you have to accept that you can stay on hold for a long time or have unresolved problems. However, it must be said that the customer service of CFD brokers may not work on weekends or after business hours. Therefore, before opening a trading account with a broker, take care to fully understand the availability of customer service from the broker you choose.

Educational materials

Many cryptocurrency exchanges don’t offer much material in terms of teaching, and in any case the material, if any, is not very easy for beginners to use.

Instead, CFD brokers tend to have a good amount of educational material on their websites and cater to both beginners and experienced traders. In short, there will not be such a large learning curve as is the case with exchanges!

Another feature of the educational material offered by CFD platforms is that it is very practical material: it explains exactly how to make money with Bitcoin, without wasting time with theory.

Cryptocurrency Exchange: best alternatives

The best cryptocurrency platforms, therefore, are not exchanges.

At this point you may be wondering which brokers you can consider to invest in cryptocurrencies.

The first name we recommend is that of eToro, a broker that is among the elite of the sector thanks to the presence of a secure, complete and always up-to-date platform. Its strength is Copy Trading, a tool that allows you to observe and monitor the operations of the best crypto traders, giving you the opportunity to copy them.

With just a few clicks, you will be able to identify, choose how much to invest and start copying Popular Investors’ operations, immediately obtaining the same profits as an expert!

Register on eToro to try its Copy Trading for free and invest in cryptocurrenciesThe second broker you should try is Trade.com. As you will see from the first steps taken within it, this broker places an emphasis on training, providing all members with a complete course to learn how to invest in cryptocurrencies and beyond.

Exchanges will never offer you such a service: here instead you are taken by the hand and supported in your professional growth, all completely free. Not to mention the precious Trading Signals service, very useful to always know the best times to enter the market, even if you don’t have time to follow the charts and price changes of the assets you follow!

Register on Trade.com and learn how to invest professionallyThese platforms allow you to register with a free demo account, without restrictions and without risk: take advantage of it!

Conclusions

In our view, even admitting the fact that cryptocurrency exchanges are indeed catching up with CFD brokers, being relatively young in comparison, the choice of a retail trader should be directed towards brokers such as eToro and Trade. com, for the reasons we have explained at length above.

Using a CFD broker would be a wiser choice, as it offers you greater security and specialised platforms for online trading, simpler and more effective to use.

Cryptocurrency exchanges, on the other hand, may be better for those who actually want to own the cryptocurrency they are trading, particularly if they are passionate about crypto. Again, however, there is a good solution from CFD brokers.

Some operators such as eToro (official website) allow you, through their specific service, not only to be able to buy cryptocurrency, but also to be able to place it within your wallet.

To leave us with some small ideas, remember that:

- With a contract for difference broker you will never own the asset. With a digital currency exchange, however, you will be “physically” in possession of the asset and can keep and use it at will;

- Regulation has not yet reached a full level of maturity in the world of exchanges compared to CFD brokers;

- Trading with a CFD broker is much faster. Trading with a cryptocurrency exchange, on the other hand, can be more complicated and time-consuming;

- Cryptocurrency exchanges offer a wider selection of currencies to trade. CFD brokers are more likely to offer only the best digital currencies, although – probably – more than enough.

In any case, make your choice intelligently and not trusting the opinions of some friends (unless he is a great cryptocurrency expert) or of posts written on a cryptocurrency forum by a stranger.

In many cases they presented reliability problems. They also charge heavy transaction fees and are not very efficient.

Exchanges are only recommended for those who want to keep possession of cryptocurrencies for a long time.

Definitely CFD brokers. Unlike cryptocurrency exchanges, they are safe, efficient, fast and do not charge fees.

Unfortunately they are not regulated, there are no central authorities that control and therefore everything depends on the honesty of those who manage it. History teaches us that, at least until today, exchange managers have not been very honest.