Market Maker Broker: how they works [Best ones]

Have you heard of Market Maker Broker but you don’t exactly understand what it is?

We are here to fill any kind of gap!

In fact, we wanted to dedicate an in-depth study on this theme trying to understand:

- What is a market maker broker

- What are the characteristics

- What are the differences with ECN brokers

- How the best market maker brokers like eToro (official site) work

We therefore recommend that you take a few minutes to read our ratings. It will be worth it!

Read also: What is online trading

Index

What is a Market Maker Broker

In order to fully talk about market maker brokers, let’s start by remembering that market makers play a very important role in trading derivatives such as CFDs (and more). And, in fact, they are the most popular operators for retail traders who wish to trade many different types of financial instruments, in numerous markets.

Their role is clear: market makers are present on the market to guarantee the expected levels of liquidity on the financial markets. Therefore, it is a professional structure that carries out a large volume of transactions by placing itself as a “counterpart” of its own clients, without these having to actually go to regulated markets in order to carry out their operations.

Anyway, it is good to clarify one thing immediately. It is absolutely not essential that you know what market makers do! Unless, of course, you have the aspiration to join a financial institution and get a job as such. However, it is still useful to understand why they exist and the effect they have on the markets.

And for this reason in the next few lines you will certainly find many ideas that could be for you.

What Market Maker is for

The key role of a market maker is to ensure that markets run smoothly, allowing traders to buy and sell financial products even if there are no orders available that match what the trader wants. Therefore, market makers maintain large and diversified portfolios of a wide range of contracts, allowing the trader to be able to open and close their operations at any time, with the certainty of always finding an operator (in fact, the market maker) ready to place himself as a counterpart.

For example, if a trader wanted to buy specific financial instruments, but there was no one else on the stock market to sell those certain instruments, then a market maker would sell the instruments in their portfolio to facilitate the transaction.

Similarly, if a trader wishes to sell their financial instruments but there is no buyer on regulated markets ready to take over such instruments, then a market maker can step forward to execute the transaction by purchasing those instruments and adding them to their portfolio.

So far, a brief overview of the role of market makers. Which, basically, we can summarize in a single statement: market makers – basically – make sure that there is depth and liquidity in the stock exchanges.

In fact, in their absence, the transactions carried out would be significantly lower and it would be much more difficult to buy and sell financial instruments. There would also be fewer options in how the different contracts available in the market would be made available.

Furthermore, allowing traders to execute trades quickly, even if there is no buyer or seller willing to close them, in turn ensures that exchanges operate efficiently and that traders can buy and sell the contracts they want with more confidence.

Obviously in this guide we only deal with market maker brokers who are reliable and safe, therefore authorized and respectful of ESMA regulations that protect traders.

Read also: Living by Trading

How does a Market Maker Broker work?

So let’s take another step forward in knowing the market maker brokers, and let’s try to explain in a simple way how they operate.

As we said, market makers are concerned with allowing the trader to make as many different options as possible. They trade in large volumes and are able to buy financial contracts from traders who wish to sell them and sell them to traders who wish to buy them. Without market makers, the market could easily stagnate and trading would become much more difficult.

In exchange for the important role they play in trading derivatives (and more), market makers have a great privilege that allows them to make a profit on every single transaction, thanks to the way in which options are valued.

The price of financial products

In fact, remember that there are two main aspects of the price of financial instruments that every trader should understand. First, the actual price is made up of two main components: intrinsic value and extrinsic value. Secondly, and this is relevant to the way market makers operate, they are listed on exchanges with an offer price and an ask price. Anyone wishing to purchase contracts would pay the asking price of these contracts, while anyone who sells or writes contracts would receive the offer price.

Now, it is clear that the asking price is higher than the offer price, and that therefore a single purchase contract would pay a higher price than what the single seller would receive. The difference between these two prices is known as the spread, and it is from this spread that market makers derive their remuneration. In short, it is as if we were saying that market makers are basically allowed to buy at the bid price and sell at the ask price, thus profiting from the spread.

Let’s make an example!

Suppose, with an example, that a financial product is traded with a bid price of € 2 and an ask price of € 2.20. If an individual places an order to buy these contracts at the same time as another individual places an order to sell these contracts, the market maker basically acts as an intermediary. In other words, in this case the market maker will buy from the seller, paying the offer price of 2 euros, and then sell to the buyer at the asking price of 2.20 euros, thus making a profit of 20 euro cents per negotiated contract.

Of course, it won’t always be possible for a market maker to buy and sell contracts at the same time – otherwise there would be little need for them!

Therefore, the activity of the broker market maker can only be potentially exposed to the risk of price movements of the instruments they own. The primary objective of a market maker will be to negotiate as many contracts as possible to benefit from the spread, but always having in mind that he will have to use effective positioning strategies to ensure that they are not exposed to excessive risks.

Best Market Maker Brokers

Market makers are typically traders such as brokerage firms, banks and other financial institutions that have a specific contract with one or more exchanges to play the role of market maker. As they are not allowed to trade on behalf of investors, they must use their own capital to finance all their transactions.

Below is the complete list of the best commission-free market maker brokers:

|

Platform: etoro Min. Deposit: 50€ License: Cysec |

|

|

|---|---|---|---|

|

Platform: xtb Min. Deposit: 100€ License: Cysec |

|

|

|

Platform: iqoption Min. Deposit: 50€ License: Cysec |

|

|

|

Platform: ubrokers Min. Deposit: 250€ License: Cysec |

|

|

|

Platform: trade Min. Deposit: 100€ License: Cysec |

|

72.30% of retail CFD accounts lose money

|

|

Platform: forextb Min. Deposit: 250€ License: Cysec |

|

|

eToro

eToro is considered to be the best market maker broker, both for beginners and experts. It is a broker with a very easy to use interface, completely free and without commissions.

However, there is a single advantage that stands out above all the others and truly makes it an ideal solution for those who want to trade online: it is the only broker that offers an automatic trading system that really works.

eToro has in fact developed a system that allows you to automatically copy what the best traders in the world do: the Copytrader software.

With this software, you can select the traders who have made the highest profits in the past, with the least risk.

The user can select these traders and the software will copy all their operations in real time.

In this way, users of the broker market maker eToro have the opportunity to immediately obtain the same results as a professional trader, even if they start from scratch. And if they want, they can also learn how to trade by watching the professionals live.

You can sign up for free on eToro by clicking hereForexTB

ForexTB is the ideal Market Maker broker for beginners, whether they want to play the stock market or want to trade forex.

The interface is very simple to use but above all, subscribers are really followed step by step by a trading expert. How? By phone: the expert calls you (you don’t even have to spend on the phone call) and guides you.

Coaching services of this type can cost 500 euros per hour. With ForexTB everything is free, the only thing to do is to listen to and apply the advice received without delay.

For those who really want to learn online trading, they can download an excellent course, completely free. Hundreds of thousands of aspiring traders in Europe have downloaded this ebook because it is free, explains the practice of trading well and is understandable even by a beginner.

You can click here to download it for freeFurthermore, all those who sign up with this broker market maker have the possibility to use an excellent demo account, unlimited and without constraints.

You can sign up for free on ForexTB by clicking hereWhat are ECN Brokers?

Now that we understand how market maker brokers like eToro work, we can appreciate their main features by introducing what ECN brokers are and what they differ with market makers.

In fact, in order to frame this topic correctly, we can well underline that there are 2 different types of currency brokers that offer traders and investors access to the financial market, using completely different business models.

Considering that we have already talked about market makers, we can now introduce ECN brokers, introducing them as brokers that use ECN operators to connect directly to interbank liquidity providers such as banks, hedge funds and mutual funds.

Also for this reason they are called non-dealing desk brokers. That is, your orders will be sent directly to liquidity providers, without the intermediation of other market operators. Unlike market makers, who place themselves on the opposite side of trading, ECN brokers therefore try to find a “closure” to your requests among market operators. In short, unlike market makers, ECN brokers will not close a contract with you.

Precisely for this reason, it is evident that it changes – in ECN brokers -. also the remuneration mechanism. While market maker brokers are remunerated based on the spread, ECNs take a commission on your trading volumes. This is why it is important for them that your trading strategy is successful: the more successful you are, the more you will trade. The more you trade, the more money they will make.

Read also: Free Forex Courses

Market Maker Broker vs ECN: which is more convenient?

ECN brokers are said to be able to offer a greater degree of anonymity than market makers. By doing so, as a trader, you will be able to take advantage of a “neutral” price, and there will therefore be no distortions that could impact your strategies, tactics or current market positions.

In reality, this is a rather limited advantage, considering that today the goodness of the platforms of the main market makers is so high that you will not have any difficulty in finding full satisfaction.

Another typical advantage attributed to ECN brokers is their reliability. An ECN broker generally tends to use the latest technology to ensure trade executions are quick and seamless, offering the best available market prices and accessible spreads.

Even in this case, however, it is good to try to remember that this is not a particularly exclusive advantage of ECN brokers. Today, the best market maker brokers are in fact able to guarantee their clients access to qualified, professional and super reliable trading platforms, which you will not struggle to master even in the more detailed aspects.

It is therefore of greater interest to understand why it is better to opt for a market maker broker rather than an ECN broker.

Read also: Expert Advisor

Transparency of Conditions

ECN brokers offer variable spreads which are generally dictated by current market conditions. Sometimes these differences can drastically change, especially when there is a high volatility that can affect your trading strategy and affect your open positions.

Market maker brokers, on the other hand, always offer very transparent conditions, with basically fixed spreads, able to allow you a better understanding of what happens on your trades.

Very often those who decide to invest in forex with ECN brokers not only pay triple or quadruple commissions, but do not even realize what they are paying.

Transaction Costs

Working with a real ECN broker, which connects you directly to market participants, including major financial institutions, comes at a huge price!

In short, opening an account with a real ECN broker can lead to the need to deal with not insignificant costs, especially for retail traders. For example, some brokers charge a fee of several euros per transaction, which can quickly erode the margins of retail traders.

We remind you instead that market makers operate without charging any cost to traders. For them, in fact, the remuneration of the assets is mainly represented by the spread, or the difference between the bid and ask prices of listed financial products.

Conclusions

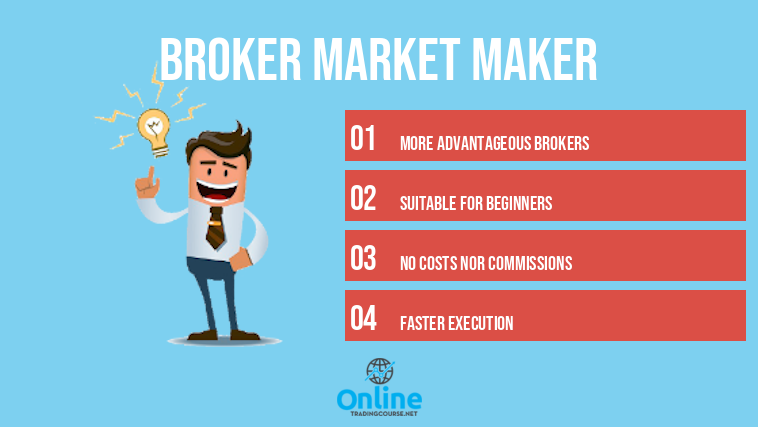

When you use a market maker broker you get several advantages that are very difficult to try to give up.

Although large professional traders, who move a particularly important financial volume, may find greater satisfaction with some ECN brokers, we believe that 99% of retail traders will prefer to trade for free with market makers such as eToro or ForexTB.

Moreover, our suggestion, in order to understand how the respective platforms work, is to open a demo account with these brokers.

A demo account will allow you to understand how the services of market maker brokers work without risking even one euro of your capital. In fact, the broker’s virtual money ceiling will be used for carrying out trading operations, made available precisely to allow the investor to get used to it a little while waiting to trade with real capital. What do you think? What is your experience with market maker brokers? What do you recommend?

This term means that the Broker provides liquidity to the market, acting as a counterparty between buyers and sellers.

No, the controls are extremely strict and rigid, it is not possible to practice unclear behaviors.

Although the choice may be subjective, the Market Makers offer lower spreads and guarantee the execution of the order, which is not the case in ECNs when there is no counterparty.

Definitely eToro, with 10 million customers around the world and advantageous trading conditions.