Revolut review: is it good for Trading?

There are numerous Apps that allow you to manage a bank account in a smart way and one of these is undoubtedly Revolut. But this App also allows you to trade in stocks and cryptocurrencies, does it work properly?

In this review we will evaluate Revolut in all its features, providing you with information and data necessary to analyze its strengths and weaknesses.

We will also make a comparison between Revolut and online brokers such as eToro, to understand if this card, which is believed to be a bank, can also act as an intermediary for trading, or is not up to the level of the brokers listed below:

|

Platform: etoro Min. Deposit: 50€ License: Cysec |

|

|

|---|---|---|---|

|

Platform: xtb Min. Deposit: 100€ License: Cysec |

|

|

|

Platform: iqoption Min. Deposit: 50€ License: Cysec |

|

|

|

Platform: ubrokers Min. Deposit: 250€ License: Cysec |

|

|

|

Platform: trade Min. Deposit: 100€ License: Cysec |

|

72.30% of retail CFD accounts lose money

|

|

Platform: forextb Min. Deposit: 250€ License: Cysec |

|

|

Index

What is Revolut?

Revolut is a prepaid card that works also as a bank and offers accounts in Pounds and Euros.

The account can be created and managed via an excellent smartphone app, without having to go to a physical “branch”.

By opening the account, you get an IBAN and a prepaid physical card that can be used anywhere in the world, also (and above all) to withdraw from ATMs.

Within the app you can quickly convert money into 30 different currencies and this makes Revolut perfect for frequent travelers.

You can make instant payments, transfer money, invest in stocks and buy cryptocurrencies, all wrapped up in a well-designed and very intuitive application, available for Google Play and iOS.

Revolut’s goal is to offer a flexible bank, perfect for managing daily banking operations.

How does Revolut work?

As we said, Revolut is a prepaid card linked to an account that can be managed entirely from the smartphone.

Among the options available to a Revolut customer is the possibility of converting money in 30 currencies (up to 1000 Euros per month with the free account), making payments and withdrawals in cash in 130 countries without commissions (up to 200 Euros per month with the free account).

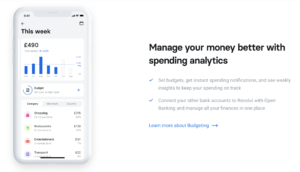

Revolut works like a classic banking app, allowing you to block your card, check your balance, review transactions and much more.

The Revolut account can be topped up by bank transfer or credit card, but in the latter case a 1% commission is paid and this is a cost that we consider excessive.

Currently with Revolut it is also possible to buy cryptocurrencies and invest in shares, let’s see what it is in the next paragraph.

Revolut Trading and Cryptocurrencies

Let’s start by saying that Revolut is not a real broker and does not have the possibility to directly access the stock markets but uses external brokers to offer its users the possibility to invest in shares.

Revolut doesn’t even offer CFDs (Contracts for Difference) but allows you to make fractional purchases of stocks.

Revolut currently allows you to buy over 750 (American) Stocks starting from just € 1 per trade. You do not get hold of the entire title but only a fraction.

Unfortunately you cannot do online trading in the strict sense of the term, it is not possible to sell short or invest by aiming downwards and the platform is quite basic, nothing comparable to that of an online broker.

Another negative side are the commissions, in the free account you can only do 3 trading operations per month for free, in the Premium one (from € 7.99 / month) 8 and only with Metal from € 13.99 / month transactions are commission-free.

In addition to stocks, Revolut offers the possibility to buy cryptocurrencies, even if they are only 5 at the moment:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

You cannot receive or send cryptocurrencies with Revolut so the management of crypto is very limited. Furthermore, as for stocks, even with cryptocurrencies you cannot invest for the downside.

Revolut alternatives for Trading

Revolut does not allow trading in the strict sense, it is not a real Broker but offers a service for the purchase of stocks (in a fractional way) and some cryptocurrencies.

Revolut’s flaws in trading are:

- Cannot sell short (invest downwards)

- You pay commissions (except with the Metal account)

- The trading platform is very meager

- No investor support

To remedy these defects, we advise you to use real online brokers for trading stocks and cryptocurrencies, possibly offering CFDs, in this way you will not pay commissions and there will be no fixed costs to be incurred such as monthly subscriptions, etc.

Here are the advantages of CFD Brokers over Revolut:

- They offer commission-free trading

- There are no subscriptions to pay

- You can also sell short

- Very professional trading platforms

- You can invest in a wide range of securities and assets, including Commodities and Equity Indices.

- They offer significant investor support

Below we show you the characteristics of the best online brokers for trading stocks and cryptocurrencies: eToro, ForexTB and Trade.com.

eToro

eToro is the most popular online broker in the world, has convinced over 10 million users and offers the most intuitive trading platform on the market.

The number of securities and assets that can be traded with this Broker is enormous, no commissions are paid, there is no subscription or fixed expense to be incurred and security is guaranteed by the CONSOB license.

What has contributed most to the popularity of this broker is its patented feature called Copy Trading.

It is a system that allows you to invest by copying the operations of the best traders in the world, chosen by you on the eToro platform.

How is Copy Trading used?

- Register on eToro, it’s free.

- Log into your Demo or real account (by depositing at least € 200)

- In the People section you can choose the investors to copy, evaluating the level of risk.

- With a click, Copy Trading will copy the investments made by the chosen traders into your account.

- So you get the same returns as these investors, at no additional cost.

To give you an idea of the returns that eToro traders can get, here is a screenshot with some of those you can copy:

ForexTB

ForexTB is one of the CFD brokers that is most gaining momentum in Europe. What makes it so interesting is its focus on investor training and support, right where Revolut lacks the most.

Online trading is not a simple discipline, you shouldn’t improvise and to help novice traders, ForexTB has created a Trading Course. This ebook is the most downloaded in the industry and represents a detailed manual for trading online, with all the secrets and strategies you need to know before making investments.

The course is free and to download it just use the link below:

Download the Trading Course for freeOf course, the trading platform offered by this Broker is state-of-the-art, full of high-level tools and indicators.

But what this Broker particularly cares about is offering support. In addition to the trading course, ForexTB aims to make trading easier, especially for investors with little experience.

Traders who use ForexTB receive free Trading Signals, they are very precise investment indications, developed by Trading Central, which make everything easier.

To receive ForexTB Trading Signals for free, click hereTrade.com

Trade.com completes our selection of alternatives to Revolut and does so by compensating for one of the most important shortcomings of the debit card we are analyzing: investor support.

This Broker offers free help and advice from a dedicated consultant, which allows you to invest without making the classic mistakes of novice traders.

Furthermore, the minimum deposit threshold to open a trading account with Trade.com is only € 100, among the lowest in the market.

Like the previous online brokers that we have examined, Trade.com also allows you to trade thousands of stocks, numerous cryptocurrencies, indices, commodities, etc.

But if you are still inexperienced in trading, you will surely appreciate the Trading Course that this Broker makes available to investors for free.

The pdf explains the basics of online trading without too many technical terms and with numerous clarifying examples. You can download the course for free from the link below:

Download the free course by clicking hereBefore depositing the € 100 to access the real account, you can practice in the free Demo account provided by Trade.com, it is identical to the real one but there is no risk!

Click here to sign up for freeRevolut: Costs and Commissions

At this point in our review, you have a clearer view of the strengths and weaknesses of Revolut, which in our opinion is not suitable for trading, while it is an excellent card to use when traveling.

Let’s explore the costs and commissions provided by Revolut, so that you can do the “math”.

The currency exchange function offered by Revolut is really useful, it allows you to convert over 150 currencies at the current exchange rate.

There are no commissions for this conversion up to a maximum of € 6,000 per month, after which a commission of 0.5% is triggered.

The fees for converting fiat currencies into cryptocurrencies range from 1.5% to 2.5% depending on the account, while CFD brokers do not charge commissions to buy or sell cryptocurrencies.

Revolut stock trading provides a fee of € 1.00 for each transaction executed and 0.01% per annum on the assets held in the portfolio.

We remind you that in online trading with CFD Brokers (such as eToro) no commissions are paid.

With Revolut there are also limits on the amount per single operation and they are 1000 €. To make larger investments, it is necessary to make individual operations of € 1000 each.

Is Revolut Safe?

This is one of the most important aspects for a trading platform and we have not talked about it so far because Revolut is practically a bank, so there are no problems on the security side using this application.

Even though Revolut is not a real broker, it does not have direct access to the markets and does not offer CFDs, it is a safe broker.

The alternatives we have proposed (eToro, ForexTB and Trade.com) are obviously just as safe, all regulated by control bodies such as our CONSOB, CySEC or FCA.

When opening an account with Revolut you follow the procedures that all online banks adopt. There is identity recognition for anti-money laundering regulations and a series of security checks.

The application is well designed and protected by the classic security systems used by banks and credit card institutions.

Revolut Pros and Cons

In this paragraph we try to summarize the pros and cons of Revolut.

Pros

- It is a virtual bank that allows you to keep 30 different currencies in the same account

- It is very easy to set up and open an account.

- Allows you to access cash via ATMs all over the world, without commissions (with certain limits)

- Offers various insurance policies included in Premium and Metal accounts

Cons

- You pay a supplement on weekends and holidays of 0.5% for major currencies and 1.0% for less popular ones

- The amount of the free conversion between currencies is limited to 6000 euros per month

- It only allows you to buy stocks but not to sell short

- The trading platform is very basic and unsuitable for trading

- Commissions are paid for the purchase of cryptocurrencies

- Apart from the first 3 free trades per month, you pay a commission to invest in stocks.

Conclusions

Revolut is excellent for day to day banking and is perfect for frequent travelers but not an online broker and not convenient for stock trading or cryptocurrency investing.

If you are looking for a broker to invest, you need a more professional broker, with a high-level trading platform and possibly without commissions, like the brokers we have proposed as an alternative to Revolut.

The advice we would like to give you is to sign up for the Demo account of the Brokers we have examined, there are no risks and it costs nothing. Do all the tests to evaluate the platforms and brokers, then choose the one you prefer and make the minimum deposit necessary to open the real account.

Here are the official links of the Demo accounts offered by the CFD Brokers we talked about:

- Access the eToro Demo account for free by clicking here

- Sign up on ForexTB and log into your Demo account by clicking here

- Register on Trade.com and try the Demo account by clicking here

Revolut is a prepaid card with the functions of a bank account. It allows you to convert over 30 currencies quickly and economically.

Not really, it allows you to buy stocks but not sell short. Not a real broker.

Yes, they are € 1 in operations to buy shares and from 1.5% to 2.5% to buy cryptocurrencies.

No, the commissions and the inability to sell short make Revolut unsuitable for trading, better to use an online broker like eToro.