Jesse Livermore Strategies: Best Trader All Time

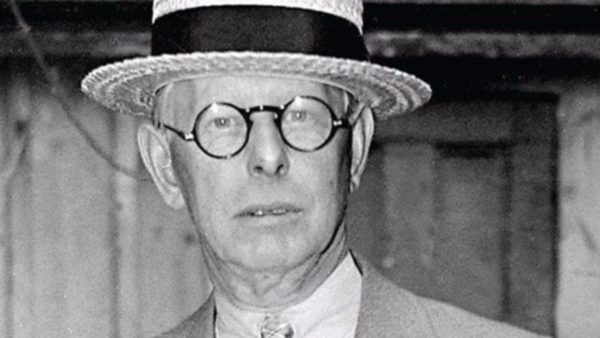

It is not easy to define who has been the best trader of all time, but for many analysts this recognition is attributed to Jesse Livermore.

Although many young investors do not know who he is, this trader, who reached the top predicting the crisis of 1929, was worth 100 million dollars at the time (over 1.5 billion today), an amount of money that, in those years, few people in the world had.

Now for trading we use sophisticated platforms that at the time of Livermore did not exist: online brokers like eToro, which allow you to trade without leaving your home and without paying commissions. But the technical analyst that was done with pencil and paper is very similar to that visible on today’s interactive graphs.

Index

Who is Jesse Livermore

Jesse Lauriston Livermore was an American trader who lived between 1877 and died suicide in 1940.

We are at the dawn of Day Trading and this investor is one of the pioneers, as the book Reminiscences of a Stock Operator tells about him.

He experienced times when he was considered one of the richest men in the world but in the end, when he committed suicide he had accumulated several debts.

We have to keep in mind that when Livermore was trading, the balance sheets were not accurate at all and the prices were subject to manipulation. Jesse Livermore based his trading on what can now be called technical analysis.

Everything that derives from his techniques and the rules that Livermore followed, are still studied, including the emotional effects on the trader’s psychology.

Some bearish operations that Jesse Livermore did in his career, short sales before catastrophic events such as the San Francisco earthquake in 1906 or the stock market crash of 1929 made him legendary and many consider him the greatest trader of all time.

Jesse Livermore: What platforms to use to invest?

In the days of Jesse Livermore there were no trading platforms, everything was done in an analogous way, but now the trading platforms are fundamental for investments.

The best platforms to trade on any market, safely and without paying commissions, are CFD Brokers.

These Brokers offer contracts for difference (CFDs) that allow you to trade on Shares, Indexes, Commodities, etc. both upward and downward.

Invest with CFD Brokers

Here are the requirements that a CFD Broker must possess in order to operate safely:

- No commissions

- A CONSOB license, CySEC or equivalent, to guarantee the security of the funds deposited

- The possibility of investing both upwards and downwards (Selling Short)

The best CFD Brokers to trade following Jesse Livermore’s strategy and rules are eToro and ForexTB.

eToro: Automated trading and intuitive platform

eToro is the online Broker with the largest diffusion in the world, its over 7 million active users can confirm its reliability and its versatility.

This CFD Broker is regularly registered with all the European licenses and its trading platform is among the most intuitive and fastest on the market.

To invest, just choose an Index, a Share, a Commodity, etc. click on the “Invest” button on the platform, decide how much to bet on the operation and whether to buy or sell (short).

Those who prefer to have their money managed by expert traders can do so with a tool patented by eToro: Copy Trading.

This system copies the operations of the best traders in the world (on eToro) automatically and without additional costs.

Copy Trading offers two great advantages:

- You can get the same results as experienced traders

- You learn the strategies of these big investors without any expense and without having to take expensive courses

Here are the steps to follow to use Copy Trading:

- Register on eToro with the link at the end of the review

- In the “Copy People” section choose the traders to copy, based on their returns

- With a click, Copy Trading will copy the operations of the chosen traders to your account

So you will get the same returns as these trading experts (in proportion to the investment), without doing anything.

With this tool even a novice investor can earn as a trading expert, because he copies his trades!

Here are the returns of some eToro traders that you can copy:

Both “automatic trading” and “manual trading” can also be tested on a free Demo account, without taking risks, with virtual money.

Click here to sign up for freeTo learn more, read our full eToro review.

ForexTB: Trading Course and Operational Signals

ForexTB is a Broker authorized by CySEC, which seeks to bring success to every investor thanks to training and operational support.

The training begins with a trading course considered among the best ever, an ebook that explains the basics of trading and technical analysis in a clear and detailed way, available for free with the link below:

Click here and download the trading course for freeTraining needs practice and ForexTB offers two trading platforms, both free:

- The Web platform, very simple and usable by any browser and device without downloading any software

- Metatrader 4, the most used trading software in the world, is very technical and full of customizable tools and indicators

The operational support of this broker is based on free Trading Signals sent to investors. These are very reliable indications, developed in collaboration with Trading Central, with an accuracy rate of 70%.

To receive free trading signals click hereRead our ForexTB review for more information.

Jesse Livermore: A Legendary Trader

Jesse Livermore is considered a legendary trader, and is certainly one of the most famous traders in the world also because he has always negotiated with his own funds, as an independent trader.

This trader used a buying strategy during the bullish and selling markets when there were obvious trend reversals, he never went against the market.

He believed that commitment and discipline were key components that separated the winners and losers in the investment world.

Of course, the lessons that this trader leaves us are not all to be taken literally, Livermore also talks about provoking small market movements by buying a few thousand stocks personally. It is now unlikely that a single trader, who does not have the capital of Warren Buffett or George Soros, will be able to move the market even a few points.

But the rules and strategies put in place by Jesse Livermore are still the basis of modern trading, let’s understand the trading principles of this extraordinary investor, author of “How to Trade in Stocks”.

Jesse Livermore: Price Models

As we mentioned, Jesse Livermore could not graphically represent the price trend with the ease with which it can be done today but had to write everything down on a “ledger”.

He negotiated trending stocks and once they reached crucial levels, he waited to see if they surpassed or reversed direction.

Let’s take an example to better understand its pricing models:

- If a stock goes down to a minimum of $ 100 and then bounces back to $ 120 and drops back to 100, Livermore’s rules say to wait before entering the market

- If the price breaks the $ 100 downward of $ 5, you have to sell it short

- If, on the other hand, the stock bounces again (at least $ 5), you enter long (you buy) paying attention to the Pivot Point of $ 120

- Over $ 125 the position increases, otherwise it closes at $ 115

These $ 5 that act as “variable to perform an action” are not fixed, it is a differential that varies depending on the volatility of the security and the price levels.

Jesse Livermore Rules

The price models we have seen, together with the analysis of the volumes, also served to evaluate how much to keep the position open, here are some rules followed by Jesse Livermore that confirmed the trade:

- Increase in volume on breakout levels

- After the breakout, prices are expected to move in that direction

- It is normal for prices to go slightly against the trend, but the volume on the retracements is lower than that shown when the stock runs in trend

- At the end of the normal opposite reaction, the volume increases again in the direction of the trend

When any of these “rules” were broken it was a signal of an action to be taken, which could have been the exit from the trade or a lightening of the position.

Timing in Trading

All traders know all too well how important timing is in trading, an operation opened too late or too early can make all other analyzes useless.

Jesse Levermore believed that we must always wait for a confirmation from the market when we have an intuition or we see a probable trend that is developing.

As soon as confirmation is received, which can be, for example, the passing of a certain number of points on a Support or Resistance, then you immediately enter the market!

Jesse Livermore Strategy

Jesse Livermore’s strategy is based on simple rules, but these despite having about a century, are always valid and are part of the investment plans of many modern traders.

- Trade following the trend. Buying in a bull market, Selling in a bear market

- Do not trade when there are no clear opportunities

- Trade using Pivot Points

- Wait for the market to confirm “intuition” before entering the market. Patience brings the biggest gains

- Let the profits run

- Enter a stop loss before entering the market

- Exit trades if the prospect of further profits is remote (the trend is over or waning)

- Trade the main stocks in each sector: The strongest stocks in a bull market or the weakest stocks in a bear market

- Don’t average your losing positions

- Be careful not to increase the margin and not to widen the stop: If the risks increase it is likely to face heavy losses

- Don’t follow too many stocks and too many trades

Jesse Livermore, among his famous phrases, always said:

There is nothing new on Wall Street. There cannot be, because speculation is as old as the hills. Whatever happens on the stock exchange today has already happened before and will happen again.

Conclusions

Jesse Livermore made a fortune, but also lost several times the accumulated capital and always analyzed the losses saying that when it happened, he usually didn’t follow his own rules.

The strategy and rules are fundamental to make money with trading, if they are wrong they must be changed but once defined they must be followed with precision and discipline, without leaving room for emotion.

To evaluate if your strategy and the rules you have set yourself, there are Demo accounts that allow you to practice without risking money. In these identical accounts, the money is virtual and unlimited.

Here are the links to access the Demo accounts of the best trading platforms that we have reviewed:

- Access the eToro Demo account for free by clicking here

- Register for free on ForexTB and access the Demo account from this link

Jesse Livermore is considered the best trader of all time and lived between 1877 and 1940.

Jesse Livermore created the basic rules of technical analysis, understanding price movements like no other at the time.

Jesse Livermore predicted the collapse of 1929. He was positioned downward with a large short sale that earned him a fortune.

CFD Brokers like eToro are suitable for testing Jesse Livermore’s strategy safely and without paying commissions.