Buy Zara Shares: Forecast and Target Price INDITEX

It is difficult to enter a shopping center or go to the central street of a big city and not come across a shop branded Zara. Behind this brand is one of the most important clothing companies in the world and many investors are considering whether to buy Zara shares (or rather Inditex), considering the extraordinary growth of this Spanish group.

In fact, the name of the company is Inditex SA and includes many other brands in addition to Zara, but this is the name with which the company was born and many still call the group with the name of its flagship brand.

The strength of this multinational lies in its economic convenience. They offer good quality garments at very low prices, which they can afford thanks to the huge market available and the optimization of the production cycle.

To understand if this is a title that deserves attention we will evaluate:

- The economic situation of the Company

- The market and competitors

- Industry analysts’ forecasts

Here is a diagram highlighting the relevant data of this Spanish company:

| Listing | 👜 Madrid Stock Exchange |

| ISIN | 📌 ES0148396007 |

| Benchmark | 📃 Ibex 35 |

| Established | 📅 1975 |

| Sector | 🧪 Clothing |

| Ticker | 🏷️ ITX |

| Turnover | 💰 € 20,4 billion (2020) |

| Best Platforms | 📈eToro / Trade.com |

To buy Zara (Inditex) shares you need a Broker, so here is a short list of the best online trading platforms on the market:

|

Platform: etoro Min. Deposit: 50€ License: Cysec |

|

|

|---|---|---|---|

|

Platform: xtb Min. Deposit: 100€ License: Cysec |

|

|

|

Platform: iqoption Min. Deposit: 50€ License: Cysec |

|

|

|

Platform: ubrokers Min. Deposit: 250€ License: Cysec |

|

|

|

Platform: trade Min. Deposit: 100€ License: Cysec |

|

72.30% of retail CFD accounts lose money

|

|

Platform: forextb Min. Deposit: 250€ License: Cysec |

|

|

Index

Zara Shares: Live price

Here is the real time price chart of INDITEX (Zara):

ZARA: The Company

Zara was born in 1975, when Amancio Ortega opened his first clothing store in the city of La Coruña, Spain. The store offered fashionable garments at low prices and the success was overwhelming.

So much so that Ortega began to open shops and factories throughout Spain, and then expanded to Europe and America.

It went public in 2001 with a very successful IPO on the Madrid Stock Exchange and the entry of the stock in the IBEX 35 Index.

In a few years the company became a multi-brand giant. The Zara brand is joined by many other commercial brands such as Pull and Bear, Bershka, Stradivarius and Oysho, to name a few.

From a small family shop, the resourcefulness of the Ortega family has led this brand to establish itself all over the world, up to opening some e-commerce to further expand the business.

Since 2019 Inditex is the largest clothing company in the world by turnover.

How to Buy Zara Shares

For many analysts, Zara represents a Value investing, because the stock (according to these experts) does not yet reflect the success of the group. If you want to buy Zara shares, you just need a PC and an online broker.

The intermediaries that you can use for this purpose are of two types:

- Traditional brokers, which provide for the opening of a securities account, the payment of stamp duty and trading commissions.

- CFD Brokers, who offer Contracts for Difference, do not need a securities account and offer very favorable conditions.

Investors who aim for the long term and have large financial resources can also overshadow the commissions and use traditional brokers, especially if they do few trades per month.

If, on the other hand, you love online trading and prefer to make small investments and rake in profits frequently, it is better not to waste money on commissions and choose CFD Brokers, which among other things have a whole range of advantages:

- Allow to do Short Selling

- The initial deposit is low

- Small investments can be made

- The trading platforms are very intuitive

- No trading fees are paid

- There is a Demo account to practice

Where to Buy Zara Shares

Once you have chosen the type of intermediaries you want to use to buy Zara (Inditex) shares, you have to decide which broker to use.

Don’t worry, you can’t go wrong if you choose regulated brokers only.

The license is essential when making financial investments, especially if issued by highly prestigious entities such as CONSOB or CySEC, which have authorized all the online brokers proposed in this guide.

In the next paragraphs we have selected the 3 best brokers to buy Zara shares, start by evaluating their characteristics:

eToro

eToro is one of the most famous brokers in the world and its reliability is also confirmed by the over 20 million registered users.

But it is his trading platform that has really made a difference. With this extraordinarily intuitive software you will be able to trade CFDs of stocks, indices, commodities, currencies and cryptocurrencies.

Here’s what the Zara (Inditex) stock looks like on the eToro platform:

How to buy Zara Shares on eToro?

- Register on eToro

- Log into your Demo or real account (by depositing at least € 50)

- Select the stock Zara (Inditex) and click on “Trade”

- Decide whether to buy or sell the shares and how much to bet in the operation

If you prefer to delegate your investments to more experienced traders, eToro offers you its fabulous Copy Trading. A truly revolutionary patent, which allows you to Copytrading the market operations of the best traders in the community, chosen by you on the platform.

In this way you will get the same returns (based on how much you have invested) of the traders you have decided to copy.

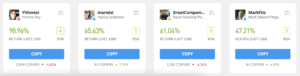

Here are some examples of traders you could copy:

Past performance is no guarantee of future returns

Click here and choose which traders to copyTrade.com

Trade.com is a financial intermediary that has achieved great popularity internationally.

In Europe it can operate thanks to CONSOB authorization, which confirms the reliability of this financial intermediary.

The offer of securities is one of the strengths of Trade.com, which allows you to trade without paying commissions in stocks, commodities, indices, cryptocurrencies, forex, etc. through CFDs.

For newbies there is a fantastic free Trading Course that this Broker has created with great attention to detail. The pdf lays the foundations for technical analysis and explains the functioning of the indicators and operating platforms.

To download the ebook, just click on the link below:

Download the Trading Course for free by clicking hereTrade.com offers its members two free trading platforms: MetaTrader 4 and the Web Platform.

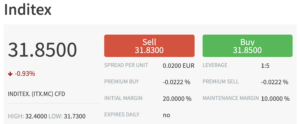

Here is what the Zara CFD (Inditex) looks like in the Web Platform:

To buy Zara shares on Trade.com you have to follow these simple instructions:

- Register for free on Trade.com

- Log into your real account by depositing at least € 100

- Select the stock Zara (Inditex) and click on “Buy” to buy or “Sell” to sell short

- Decide how much to invest in the operation

Zara Business Model

The Zara business model corresponds to that of the Spanish group that owns the brand: Industria de Diseno Textil SA, also known as Inditex SA.

The company is based in Spain and its core business is the textile industry. To be precise, the company’s activities include the design, packaging, production, distribution and retail sale of clothing, footwear and fashion accessories for men, women and children, as well as furnishings and textiles for the home.

The Company’s business is divided into three segments:

- Zara, which sells Zara-branded home and fashion items

- Bershka, which sells Bershka-branded clothes and caters to a younger audience

- Other, which sells clothing under the brands Stradivarius, Oysho, Pull & Bear and Massimo Dutti, among others

Is it worth to buy Zara shares?

The company has seen a solid revision of earnings estimates recently, which suggests that analysts are becoming a little more optimistic about the company’s prospects in both the short and long term.

Zara is for many industry experts one of the undervalued stocks to watch out for, as it could hold some surprises.

Below you can clearly see the trend of the stock, which after the 2008 crisis shows an overwhelming growth trend that lasts for almost a decade, and then slows down and suffers a severe blow in 2020, with the outbreak of the Covid-19 pandemic:

But analysts believe that the company is now recovering, the fundamentals are growing and the stock is also oriented in the same direction.

ISIN Zara

Zara’s ISIN code, which corresponds to Inditex’s listing on the Madrid Stock Exchange, is ES0148396007

Zara competitors

Zara, or rather Inditex, is a giant of imposing size, which sells clothing all over the world, but has to deal with very fierce competitors, such as:

- H&M

- Uniqlo

- Boohoo

- Abercrombie & Fitch

- American Eagle

- J Crew

- GAP inc.

- Urbn

- Aeropostale

- Forever 21

Zara Shares Forecast

Net sales of Zara (Inditex) increased 49% year-over-year to € 11.94 billion in the first half of 2021.

The EBITDA or the gross operating margin (before taxes, interest, etc.) of Inditex grew by 109% year on year to € 3.10 billion.

Its net profit rose to € 1.27 billion, which is a good result, especially when compared to the net loss of € 195 million in the first half of 2020.

In short, the fundamentals bode well for the future and analysts’ forecasts are moderately optimistic.

Here are the estimates on Zara released by the experts of some of the major international investment banks:

- Royal Bank of Canada reiterated an “industry performance” rating on Zara shares.

- Deutsche Bank has reaffirmed a “sell” rating on Zara shares.

- Zacks Investment Research has upgraded Zara stock from a “strong sell” rating to a “pending” rating.

- Barclays reiterated an “equal weight” rating on Zara shares.

- JPMorgan Chase & Co. reaffirmed an “overweight” rating on Zara shares.

Zara Target Price

According to the ratings issued by 8 sector analysts in the last year, the consensus rating for the Zara (Inditex) stock is pending and is based on 2 sell ratings, 3 pending ratings and 3 purchase ratings for the stock.

But the 12-month average target price is still on the upside for Zara and stands at € 33.74.

Conclusions

The enthusiasm of analysts is held back by the price of the stock, which is traveling towards new all-time highs and this is one of the reasons why some experts are cautious in the forecasts on Zara.

Despite this, the group’s numbers all show substantial growth and this will likely lead to increased investor interest.

In the long term there are few to express themselves, but in the short term buying Zara shares is seen almost unanimously as an excellent investment.

The CFD Brokers proposed in this guide are ideal for following the fluctuations of this stock and aiming upwards and (if necessary) also downwards, always without paying commissions.

But before investing your money on Zara, do some Demo tests and optimize your strategy. Here are the links to access the Demo accounts of the best CFD Brokers on the market for free:

Zara is a brand owned by the Spanish group Inditex which is based in Arteixo in Galicia, in the north of Spain.

The foundation of Zara dates back to 1975, when Amancio Ortega opened the first store in La Coruña, Spain.

The 12-month average target price for Zara (Inditex) stands at € 33.74.

With eToro, one of the most reliable CFD brokers on the market.