Buy Boeing Shares: Financial Analysis and Best Brokers

Boeing needs no introduction, it is a global giant in the production of planes and related components. To buy Boeing shares now may seem a good idea – given the decrease of the value of the asset – but is it really?

This guide tries to answer this question by examining the current situation of the company and the future prospects of the group.

OnlineTradingCourse.net is a point of reference for investors who seek detailed and impartial guidance on the stock market – and in this case on Boeing.

The current crisis in the travel sector has profoundly influenced Boeing shares and it is necessary to carefully evaluate whether it is better to aim up or down, using one of the most important online brokers that we will briefly review: eToro, the industry leader.

|

Platform: etoro Min. Deposit: 50€ License: Cysec |

|

|

|---|---|---|---|

|

Platform: xtb Min. Deposit: 100€ License: Cysec |

|

|

|

Platform: iqoption Min. Deposit: 50€ License: Cysec |

|

|

|

Platform: ubrokers Min. Deposit: 250€ License: Cysec |

|

|

|

Platform: trade Min. Deposit: 100€ License: Cysec |

|

72.30% of retail CFD accounts lose money

|

|

Platform: forextb Min. Deposit: 250€ License: Cysec |

|

|

Index

Buy Boeing shares: The Company

Boeing is specialized in the production of airplanes, components, and engines used in aircrafts Most large commercial airlines use Boeing aircraft in their fleet.

Boeing Company is the largest aerospace company in the world, as well as the leading commercial aircraft manufacturer.

It is also a leading manufacturer of military aircraft, helicopters, spacecraft, and missiles, a position improved significantly with the acquisition of the aerospace company Rockwell International Corporation in 1996 and its merger with the McDonnell Douglas Corporation in 1997.

Previously, it was called the Boeing Airplane Company and the company changed to its current name in 1961 in order to reflect the expansion into fields beyond aircraft production. Headquarters was in Seattle until 2001, after that Boeing moved to Chicago.

Since Boeing is a public company, it is possible to invest in the company by purchasing shares. Let’s see then how it is convenient to invest in this asset.

Buy Boeing shares with the best CFD Brokers

If you are considering to buy Boeing shares, you will search for sure the cheapest and safest method: CFDs.

These are derivative contracts that follow the price of the asset to which they refer and allow a very simple and affordable trading for everyone.

Like other financial products such as ETFs, Bonds, Futures, Options, CFDs are also authorized and regulated in Europe and other countries.

The main advantages of CFDs are:

- They can be traded directly online in total security.

- Use of financial leverage, a multiplier that allows – for example – to negotiate with 3,000 euros having only 100 in the account.

- They allow you to invest both upwards and downwards and earn (if the forecast is correct) in any market scenario.

- No commissions and the minimum deposit is between 100 and 250 euros.

You will wonder if there are only advantages with CFDs… of course not. There is one disadvantage: Since you do not really get hold of the shares, you do not participate in stock dividends, but speculate on price changes.

eToro

With the most famous online trading platform in the world, eToro is one of the few brokers that has been able to innovate and for this reason has reached 7 million active users.

In the screenshot below, you can see the Boeing asset in the eToro platform. The software is very intuitive but at the same time offers all the tools for more experienced traders.

To buy Boeing shares just click on “invest”, decide whether to buy or sell the asset (invest upwards or downwards) and how much to invest in the operation.

eToro is an authorized FCA broker and therefore extremely safe and reliable. Its offer of securities and markets is among the most extensive ever but, above all, eToro is well known for its revolutionary service: Copy Trading.

This tool allows you to copy the operations of the best traders in the world (who are present in eToro) in a totally automatic and free way.

To use Copy Trading just follow these simple steps:

- Register on eToro with the link at the end of the review

- Go in the section “people” and choose the traders to copy based on the performance.

- With a click, Copy Trading will copy exactly the same operations of the chosen traders in your account.

- At this point, you will get the same returns as these trading experts (of course, in proportion to your investment), without doing anything else.

To find out how much every trader earns, click here

Both Copy Trading and traditional trading can also be tested on a free Demo account, without taking real risks.

Click here and sign up for free

For more details you can read our full eToro review.

ForexTB

This broker has become one of the most important for online trading. Its web platform allows you to invest in Boeing shares or on other assets in a simple and safe way.

But ForexTB tries to satisfy even the most demanding trader by offering the famous Metatrader 4, a very technical platform, probably the most used for online trading.

The main services that have rapidly increased the popularity of ForexTB are:

- Trading signals: ForexTB offers for free very reliable operational signals, found by Trading Central, which are automatically sent to the trader whenever the conditions for investing in a specific asset arise.

To receive free ForexTB Trading Signals, click here

- The Online Trading Course: for all those who prefer to learn the basics of trading, ForexTB has created a course (eBook). This is a complete and practical guide to learn how to earn with online investments.

Click here and download the trading course for free

Read our ForexTB review for more information.

Boeing Finance

Boeing shares, listed on the NYSE with the ticker BA, were experiencing severe turbulence long before the coronavirus outbreak, underperforming the S&P 500 by over 28 percentage points in 2019 due to fatal accidents and the subsequent grounding of the 737 MAX plane for software problems.

Any hope of a rapid recovery in 2020 vanished due to the health crisis that paralyzed travel demand and forced airlines to rethink their short-term growth plans.

Boeing shares have lost more than 60% of their value in less than a month, resulting in much worse results than the global market during a period of strong sales.

At this point, buying Boeing shares may seem like a gamble, but there are many analysts who predict a long-term recovery, even if by looking at the chart below, it really seems a very optimistic forecast.

Financial analysis of Boeing

Boeing shares are now cheaper than they have been in the past 5 years. But does this make it a good investment?

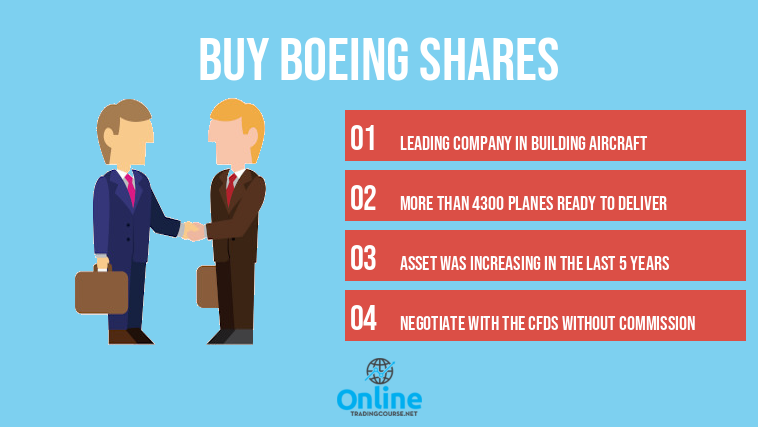

The investigation into what happened to the 737 MAX led to a series of embarrassing revelations about Boeing’s culture, but despite all, the most optimistic investors were comforted by the impressive order backlog of over 4,300 aircraft and the seemingly insatiable demand of new planes.

The commercial aircraft sector has traditionally been a highly cyclical activity and for some companies the cycle peaked before the pandemic.

Boeing nasdaq shares

Boeing shares are part of the NYSE index and not the NASDAQ. This index includes practically all companies listed on the New York stock exchange.

Despite all its problems and the dramatic drop in share prices in recent weeks, Boeing is not a particularly cheap investment. The corporate value is 14.56 times the expected profits, well above the multiples of other large industrial groups.

Boeing has traditionally been traded so avidly because of the strength and diversity of its operations, but right now the company’s dependence on commercial aircraft makes it even more vulnerable to the market than many of its competitors with slightly different focuses.

The demand for travel will not disappear permanently, and thanks to its duopoly with Airbus, Boeing will record many revenues in the years to come. It is possible to see a future in which the 737 MAX will return and the airlines will start growing again, but how long will we have to wait?

Boeing forum actions

In different forums, we can read about Boeing, which recently raised $ 25 billion of fresh liquidity through a bond sale, necessary to offset the strong interest on the accumulated debt.

The aerospace giant is said to be working with a number of investment banks in order to further sell bonds to clear a debt of over $ 70 billion.

Boeing has already taken out a $ 14 billion term loan and suspended its dividend in an attempt to limit the damage caused by the “slowdown” in air traffic in recent months.

Is it worth it to buy Boeing shares?

The answer is not simple, but we will try to explain the idea of most analysts about Boeing shares and the forecasts for the future.

The path from here is clear: Boeing must maintain its liquidity in the coming months and follow its plan to sell approximately 450 737 Max planes that have been built – but not yet delivered – within 12 months of the recertification of the aircraft.

This would allow Boeing to start the recovery phase of the company and consequently of the stock exchange title.

But although the results are likely sufficient to slow down or even put an end to the sell-off of Boeing shares, it is difficult to see a catalyst in sight that will raise the shares, especially given the situation before the coronavirus.

The dividend will probably not be distributed for several years and the current crisis vanished one of the few opportunities that Boeing had to increase commercial sales and settle past debt.

Boeing is doing what it has to do at the moment, but analysts are skeptical and do not expect a rapid recovery in the price, even if everyone agrees that in the long run, the shares will go up.

For short-term speculators, Boeing shares are still a bearish opportunity, at least until air travel resumes decisively.

Conclusions

Right now, the forecasts whether to buy or sell Boeing shares are conflicting; some analysts believe that the descent of the stock has not ended, so in this case, you could invest in the decrease in the short term until you intercept signs of unequivocal recovery.

Other analysts believe it is better to buy Boeing shares and to aim at a higher price in the long term, considering that the company will certainly recover, even considering the pre-crisis price level.

Whatever your strategy is, always keep in mind the importance of brokers. Choose only authorized and certified intermediaries, such as the ones we have presented in this guide, and do not be tempted by any offshore broker which could disappear with your money.

In order to practice without risks, start with a free Demo account, so you can test the strategies and trading platforms with virtual money.

- Practice the eToro Demo account for free by clicking here

- Register for free on ForexTB and access the Demo account from this link

The best way to buy Boeing shares is to use online brokers that offer CFDs, but only authorized FCA intermediaries.

CFD Brokers have no commissions and the minimum deposit required ranges between 100 to 250 euros.

eToro is the best online broker on the market, thanks especially to the automatic investment system called Copy Trading.

Yes, but only in a long-term strategy. In the short term, it is better to aim downwards as long as the trend is decreasing.