Buy Western Union Shares: trend and forecast

Western Union is a historic American company, famous for its money transfer services. Its history is over a hundred years old and has been able to readjust and update itself continuously. Many investors are considering whether to buy Western Union shares, so we want to take a closer look at this stock.

Its history is long and full of changes and upheavals that have seen it go through the birth of the first credit cards and arrive at modern software and fintech apps.

Western Union has shown a great ability to keep up with the times but to understand if we are talking about a good investment we need to analyze in detail:

- The economic situation of the company

- The historical performance of the stock

- The future prospects of the multinational company

In the guide you will find the main economic data and analyst forecasts, which will help you form your own opinion on the Western Union stock.

Let’s start with the relevant data from this financial services multinational company:

| Listing | 👜 New York Stock Exchange |

| ISIN | 📌US9598021098 |

|

Benchmark |

📃NYSE, S&P 500 |

| Foundation | 📅1851 |

| Sector | 🧪Finance |

| Ticker | 🏷️ WU |

| Turnover | 💰 5,6 billions € |

| Best trading platforms | 📈 eToro / ForexTB / Trade.com |

To buy Western Union shares you need a Broker, so we immediately offer you a list of the best online trading platforms on the market:

|

Platform: etoro Min. Deposit: 50€ License: Cysec |

|

|

|---|---|---|---|

|

Platform: xtb Min. Deposit: 100€ License: Cysec |

|

|

|

Platform: iqoption Min. Deposit: 50€ License: Cysec |

|

|

|

Platform: ubrokers Min. Deposit: 250€ License: Cysec |

|

|

|

Platform: trade Min. Deposit: 100€ License: Cysec |

|

72.30% of retail CFD accounts lose money

|

|

Platform: forextb Min. Deposit: 250€ License: Cysec |

|

|

Index

Western Union Live quotation

Here you can find the Real Time quotation of Western Union:

Western Union: the Company

The Western Union Company was founded in 1851 as the New York and Mississippi Valley Printing Telegraph Company in Rochester, New York.

Five years later it changed its name to the Western Union Telegraph Company and began dominating the American telegraph industry, pioneering technologies such as telex and developing a range of telegraph-related services, including early wire transfers.

Due to some financial difficulties and continuous technological changes, Western Union has changed its core business several times, adapting it to the era it was going through.

It is precisely this adaptability that has led it to still be one of the largest money transfer companies in the world.

In 2006, Western Union completely ceased its communications activities, focusing on new digital money transfer systems.

How to Buy Western Union Shares

To buy Western Union shares you need a PC, an internet connection and an online broker that allows you to trade the stock safely.

We will talk about the security issue in more detail in the next paragraph, while the choice of the Broker is divided between traditional intermediaries and those without commissions.

Classic brokers are mainly suitable for long-term investments, made with large figures, so that the commissions and costs of these intermediaries can be absorbed over time.

If, on the other hand, you are interested in trading online, trying to earn “little” and often from your operations, you need brokers without commissions, such as CFD brokers.

CFD stands for Contracts for Difference and are derivatives that allow you to trade on a security without buying it “physically” but only speculating on price changes.

Here are the main advantages of CFD Brokers:

- Demo account to practice

- No trading fees

- Possibility of making even small investments

- Very intuitive trading platforms

- Possibility to also make money if the price drops

Where to buy Western Union Shares

When choosing where to buy Western Union shares, the security issue we mentioned in the previous paragraph comes into play.

You have to focus only on intermediaries in possession of regular licenses, forget all those brokers who operate from tax havens and have no authorization in Europe, they are too dangerous.

In this guide we have proposed exclusively Brokers with CySEC or CONSOB licenses, so that you can choose freely and without any fear.

Now you will find briefdescriptions of the best CFD brokers to buy Western Union stocks, carefully evaluate and try their Demo accounts:

eToro

eToro is one of the most popular online brokers, with over 20 million registered users and one of the most intuitive trading platforms on the market.

Its safety is confirmed by numerous international licenses, but in Europe it operates under the supervision of CONSOB and CySec, which have issued a specific authorisation to this broker.

Below you can see the eToro platform with the Western Union CFD ready to be traded:

How to buy Western Union Share on eToro? Following these steps:

- Register for free on eToro

- Log into your Demo or real account (by depositing at least € 200)

- Select the Western Union stock and click on “Trade”

- Decide whether to buy or sell the shares and how much to bet in the operation

Probably the fame and diffusion of eToro is also due to the automatic investment system it has patented.

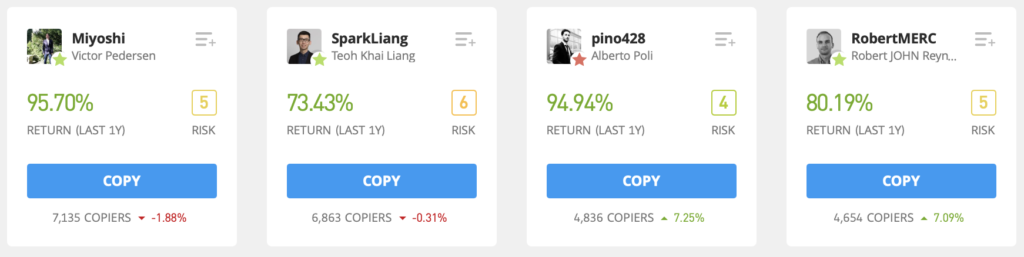

This system is called Copy Trading and allows you to copy the operations performed by the best traders operating on eToro, chosen by you on the platform.

Thanks to Copy Trading you will get the same results (based on how much you have invested) of the copied traders, here are some examples:

ForexTB

ForexTB is now very widespread nationally and throughout Europe, especially thanks to the high-level services it has developed.

Obviously we are talking about a financial intermediary with a regular CySEC license, which offers numerous securities and assets.

Among the most famous services of this Broker there is certainly its Trading Course. An ebook that explains in detail the basics of online trading and the best operational strategies.

The pdf is a set of rules and tips that facilitate the understanding of online trading and the most effective strategies. In addition, the course is totally free, here is the link to download it:

Click here and download the ForexTB Trading Course for freeForexTB offers two trading platforms, very different but both free and reliable:

- Metatrader is a complete platform full of indicators of all kinds.

- The Web Platform is simple, intuitive, fast and accessible from any device, without installing anything.

To buy Western Union shares on ForexTB you have to follow these 4 steps:

- Register on ForexTB for free

- Choose the trading platform

- Select the Western Union asset and click on “Buy” (or Sell to sell short)

- Decide the amount to invest

Trade.com

Trade.com has tried to offer a range of services that are affordable even for less capitalized investors and this has made it successful.

In Europe, this Broker operates with regular CONSOB and CySec licenses and offers a wide choice of securities and assets to bet on.

To facilitate access to investments, Trade.com offers the possibility of opening a real account with only 100 euros of minimum deposit.

In addition to the very low entry threshold, this broker has very competitive spreads and obviously has no trading commissions.

Trade.com offers two trading platforms: MetaTrader 4 and the Web Platform, two free but highly professional software.

To buy Western Union shares on Trade.com you need to follow these simple guidelines:

- Register for free on Trade.com

- Log into your real account by depositing at least € 100

- Select the Western Union stock and click on “Buy” to buy or “Sell” to sell short

- Decide how much to invest in the operation.

This Broker has tried to improve the results of its members by offering them a totally free Trading Course.

This ebook lays the foundations of technical analysis and explains what are the most effective trading strategies, here is the link to download it:

Download the Trading Course for free by clicking hereWestern Union business model

The Western Union business model is divided into two operating segments:

- The Consumer-to-Consumer segment facilitates money transfers between two consumers, mainly through a network of agents and sub-agents. In this way, cross-border and intra-country international transfers are carried out, as well as transactions via websites and mobile devices.

- The Business Solutions segment provides payment and exchange solutions, primarily cross-border transactions and currency exchange for small and medium-sized businesses.

Let’s look at some of the relevant Western Union data:

- Quotation: NYSE

- Sector: Financial Services

- Foundation: In 1851 in Rochester, New York, United States

- Headquarters: Denver, Colorado, United States

- President: Jack M. Greenberg

- CE: Hikmet Ersek

- Turnover: US $ 5.6 billion (2018)

- Net profit: $ 851.9 million (2018)

- Number of employees: 12,000 (2018)

Western Union dividend

Western Union pays an annual dividend of $ 0.94 per share, with a dividend yield of 4.04%.

WU’s most recent quarterly dividend payment was made on Wednesday 30 June. The company has increased its dividend in the last year by 8.74%.

Western Union pays 50.27% of its earnings as a dividend.

Buy Western Union Shares: ISIN

The Western Union ISIN code is US9598021098.

Western Union competitors

Western Union’s main competitors are the other money transfer multinationals and fintechs that are emerging in this sector:

- MoneyGram

- PayPal

- Ria

- Wise

- Xoom

- WorldRemit

- XE

- Remitly

- Skrill

- OFX

- Ant Financial

Is it a good idea to buy Western Union Shares?

Western Union is the undisputed leader in its industry, generating over three times more revenue from money transfers than its closest competitor, MoneyGram International.

The development of the infrastructure is a source of pride for this American multinational which is hard to match.

The global presence of the well-known Western Union brand also allows it to maintain this leadership with a certain ease.

Below we can see the performance of the WU stock over the last 20 years:

Since 2019, the share price has started a bull run that was interrupted by the outbreak of the global pandemic, but now it appears to have regained vigor.

This growth is also driven by the investments the company is making in new digital transfer methods. Western Union improved its website and launched a money transfer app in 2016.

Currently this type of transactions represents 20% of the total transactions carried out by the American multinational.

Buy Western Union Shares: forecast

Currently there are new startups and specialized companies that are gaining ground in money transfers, first of all PayPal with Xoom, but also Remitly and other fast growing companies.

None of them have the infrastructure and the notoriety of Western Union of course, but these “small” companies still gnaw margins every day for the US giant, which must hurry to convert as many customers as possible to digital without letting them escape.

Here is the uptrend of the Western Union stock:

Below we have included some of the forecasts released by the major international investment banks on the WU stock:

- Morgan Stanley raised its Western Union price target from $ 20.00 to $ 21.00 and gave the company an “underweight” rating.

- Zacks Investment Research downgraded Western Union from a “buy” rating to a “pending” rating and set a price target of $ 27.00 on the stock.

Buy Western Union Shares: target price

We looked at the forecasts of 14 market analysts who have issued valuations and price targets for Western Union over the past few months.

Their twelve-month average target price is $ 23.96, predicting a possible 3.00% upside for the stock.

The high price target for WU is $ 28.00 and the low price target is $ 21.00. There are currently 5 sell ratings, 6 hold ratings and 3 buy ratings for the stock, showing strong analyst indecision.

Conclusions

Western Union is a historic company that continues to evolve to maintain leadership in the money transfer market.

The company is moving quickly to convert its businesses and network to digital and this bodes well for analysts and shakes the hearts of investors who have started buying Western Union shares following the fluctuations and high volatility of the stock.

Currently, given the strong indecision of experts regarding long-term forecasts, it is more convenient to trade in the short-term, taking advantage of the convenience of the commission-free Brokers we have talked about.

The CFD Brokers that we have proposed offer a Demo account to practice without taking risks, you can start from there if you want to develop a good operational strategy in total safety:

- Access the eToro Demo account for free by clicking here

- Register on ForexTB and try the Demo account by clicking here

- Register on Trade.com and try the Demo account by clicking here

Western Union is headquartered in Denver, Colorado (USA).

The Western Union ISIN code is US9598021098.

The average twelve-month target price for Western Union is $ 23.96.

You can use CFD brokers like eToro, they are safe, reliable and commission free.