Buy Citigroup Shares: [The Complete Guide]

The US banking giants can offer incredible investment opportunities with moderate risk, because they are “too big to fail”. Buying Citigroup shares at this price seems like a bargain, but what should you watch out for?

There are several aspects to consider in order to make an investment of this kind and we will examine everything in this guide, starting from the financial situation of the bank and its growth prospects.

We will also highlight the steps necessary to invest in assets, which we can summarize in 3 steps:

- Choose a CFD Broker that offers a safe and intuitive platform.

- Practice on the Demo account to practice without taking risks.

- Make a small deposit to invest on the real market.

OnlineTradingCourse.net has selected the best platforms to buy AMD shares without paying commissions, one of which is offered by eToro, the market leader.

|

Platform: etoro Min. Deposit: 50€ License: Cysec |

|

|

|---|---|---|---|

|

Platform: xtb Min. Deposit: 100€ License: Cysec |

|

|

|

Platform: iqoption Min. Deposit: 50€ License: Cysec |

|

|

|

Platform: ubrokers Min. Deposit: 250€ License: Cysec |

|

|

|

Platform: trade Min. Deposit: 100€ License: Cysec |

|

72.30% of retail CFD accounts lose money

|

|

Platform: forextb Min. Deposit: 250€ License: Cysec |

|

|

Index

Buy Citigroup shares: Listing and price in real time

Citigroup: History

Citigroup Inc. or Citi (as it is usually called) is an American investment bank based in New York City.

Originating from the merger of the banking giant Citicorp and the Travelers group in 1998, today it is the third largest banking institution in the United States.

It is one of those banks named to be “too big to fail”, which are permanently part of the nerve system of the United States.

Citigroup has over 200 million customers and operates in more than 160 countries. In 2008, it was bailed out with an intervention from the US central government but underwent a major downsizing and the share price went from $ 550 to about $ 10 in 2 years.

The stock is listed on the New York Stock Exchange and is part of the NYSE, one of the most important and inclusive stock market indices in the world.

How to buy Citigroup shares

Listing on the New York Stock Exchange shouldn’t be scary, with CFD Brokers and a PC, you can buy Citigroup shares directly from your home or office.

What you need to pay attention to is the choice of the Broker, which must be a safe and reliable intermediary.

To choose a reliable Broker you need to verify that it meets the following requirements:

- It must offer CFDs, contracts for difference, that allow you to invest both up and down (short selling).

- You don’t have to pay commissions.

- It must have the authorization of at least one supervisory body such as FCA or CySEC.

To buy Citigroup shares (or sell them) on one of the trading platforms offered by these online brokers you must:

- Buy the Citigroup CFDs to earn if the shares go up.

- Sell the Citigroup CFDs to earn if the shares go down.

When the stock reaches the expected price, the transaction can be closed and any net profits collected, without paying commissions.

Where to buy Citigroup shares

There are numerous online brokers on the market, but how do you choose the right one?

Each investor has his own style and needs, so he should make a series of evaluations, examine the services offered, and compare them with each other.

If you don’t have time for these “tests”, OnlineTradingCourse.net has already carried them out and concluded that the best CFD brokers where to buy AMD shares safely are: eToro, ForexTB and Trade.com.

The final choice is still up to you: Register, try their respective Demo accounts, and choose the one you prefer.

eToro: Buy Citigroup shares with an intuitive platform

eToro with its community of over 7 million active traders is the leader of the market.

The security of this intermediary also derives from its numerous licenses, such as that of FCA.

The most interesting feature of eToro is its platform, which is fast and intuitive like few others.

Below the Citigroup stock:

To buy Citigroup shares (or sell them), you have to click on “Invest”, decide whether to Buy or Sell the stock, and how much to invest in the operation.

Its fame comes not only from the intuitive platform but also from a revolutionary patent called Copy Trading.

This system allows you to copy the market transactions of the best investors in the world (chosen directly on eToro), in a fully automated manner and at no additional cost.

To use Copy Trading you have to follow these steps:

- Register on eToro

- In the section “people”, you can choose the traders to copy based on the performance.

- With a click, Copy Trading will copy exactly the same operations of the chosen traders in your account.

- At this point, you will get the same returns as these trading experts (of course, in proportion to your investment), without doing anything else.

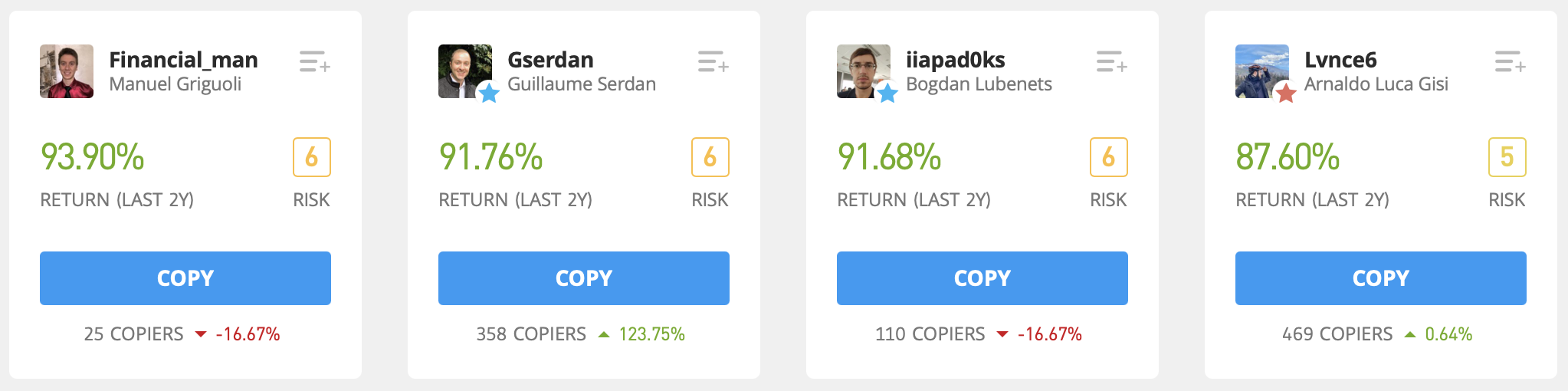

Here are some of the best eToro Traders (which can be copied):

Click here and choose which trader to follow

Both Copy Trading as well as traditional trading can also be tested on a free Demo account, without taking real risks.

Click here and sign up for free

For more details you can read our full eToro review.

ForexTB: Buy Citigroup shares thanks to the Trading Signals

ForexTB has achieved its current popularity thanks to a series of completely free services.

Clearly, this broker is also absolutely safe and can boast the authorization of the prestigious CySEC, valid throughout Europe and the UK.

ForexTB allows you to choose between 2 trading platforms, both free:

- The web platform is easy to use and can be entered from any browser without downloading any software.

- Metatrader 4 is more technical and full of professional indicators and meets the needs of the more experienced traders.

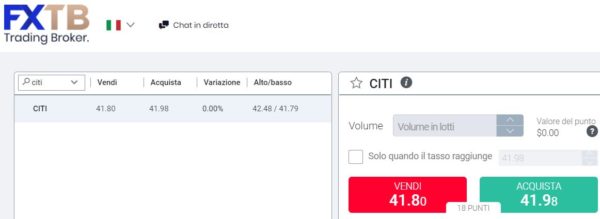

To buy Citigroup shares (or sell them) simply click on Sell or Buy and decide how much money to invest in the operation.

ForexTB’s famous trading support is based on the Free Trading Signals which are sent to all investors. These indications are very precise and are successful 70% of the time, an excellent support for online trading.

Click here and download the trading course for free

ForexTB tries to help above all novice traders and for this reason, it has created for free a Trading Course considered among the best in its category. This ebook summarizes the basics of online trading and allows you to learn technical analysis in a simple way and with practical examples.

Click here and download the trading course for free

Trade.com: Buy Citigroup shares with 100€ deposit

Trade.com notoriety has spread incredibly thanks to its very professional platform and to the entry threshold.

The minimum deposit required by Trade.com to open a real account is in fact only 100 Euros, much lower than the average on the market.

The security of this intermediary is guaranteed by FCA.

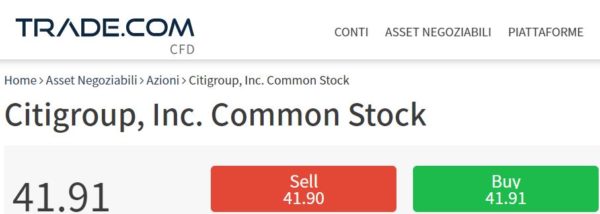

In the screenshot below, you can see the Citigroup CFDs:

To buy (or sell) AMD shares, just click on Buy or Sell and decide how much to invest.

Click here to sign up for free

Trade.com relies heavily on training, which is necessary to improve the performance of its users. The notions of technical analysis are the basis of a good profit in trading and this Broker has created a very complete trading course, a pdf that can be downloaded for free using the link below:

Download the free Trade.com course by clicking here

To open a real account with Trade.com you need at least 100 Euros, an amount lower than the average. However, to get started there is always the totally free and unlimited Demo account.

Click here to sign up for free

Citigroup’s business model

The Citigroup’s business model is divided into two segments: Global Consumer Banking (GCB) and Institutional Clients Group (ICG).

The GCB segment offers traditional banking services to retail clients, while the ICG segment offers wholesale banking products and services, consulting, negotiation, investment, and wealth management.

Below you can see some highlights of Citigroup:

- Headquarters: Lower Manhattan, New York

- Listing: NYSE (C), S&P 100 Component, S&P 500

- Sector: Financial Services

- Foundation: October 8, 1998

- Revenue: US $ 74.286 billion (2019)

- Net profit: US $ 19.471 billion (2019)

- Employees: 204,000

Is buying Citigroup shares worth it?

To answer the question of whether it is worthwhile to buy Citigroup shares, we need to examine the economic and financial situation of this banking giant.

This multinational is economically stable and seeks to expand by strengthening its presence in developing countries, from Russia to South Africa, while some rival banks are pulling out to focus on domestic markets.

This expansion policy demonstrates the group’s good health, which considers emerging economies to be fundamental when the situation tends to stabilize after the crisis caused by the global pandemic.

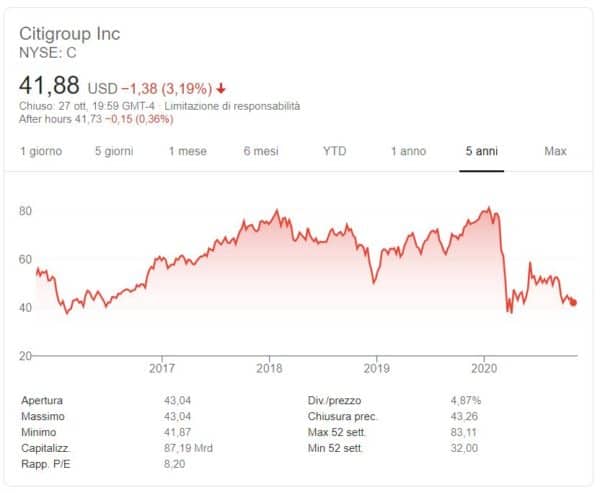

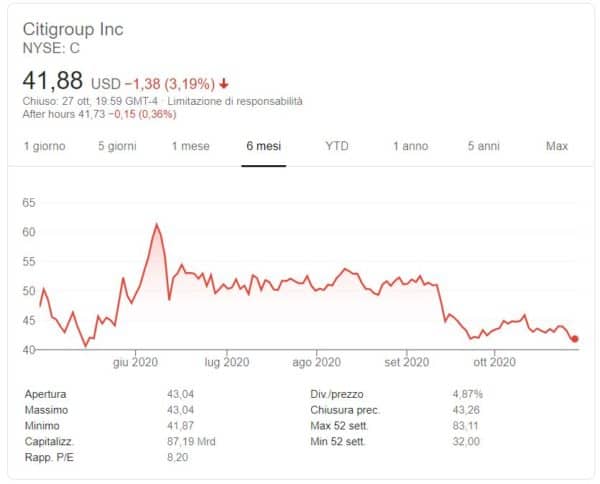

The share price, as we see in the graph below, does not reflect the real situation of the group, but it is very undervalued and offers the opportunity to make profitable investments in the medium and long term.

Citigroup’s expansion contrasts with the policies implemented by some of its European rivals. Deutsche Bank AG and Barclays Plc, for example, have downsized or withdrew from Africa to focus on their home markets.

Many other banks are narrowing the boundaries of their markets, benefiting Citigroup in its expansion.

Citigroup’s competitors

Citigroup’s main competitors are the world’s largest banking institutions. We have listed some of the most important below:

- Bank of America

- HSBC

- JP Morgan Chase

- Deutsche Bank

- Goldman Sachs

- Barclays

- Wells Fargo

- UBS

Citigroup shares: Forecasts

The 6-month chart of Citigroup stock does not do justice to the banking group’s economic situation. It also doesn’t tell us much about the future prospects, but it shows a sideways trend with a slight downward trend.

Although Citigroup growth is not expected in the short term, the main international analysts consider this stock to be one of the most interesting investments in a long-term perspective.

We have collected the valuations of some of the major international investment banks that agree that buying Citigroup shares is very advantageous given the current market prices and future prospects of the group:

- Goldman Sachs Group downgraded Citigroup from a “strong buy” rating to a “buy” rating.

- Wells Fargo & Company reduced its price target on Citigroup from $ 72.00 to $ 66.00 and set an “overweight” rating for the company.

- Oppenheimer reaffirmed a “buy” rating and issued a target price of $ 100.00 on Citigroup shares.

- Royal Bank of Canada reaffirmed a “buy” rating and issued a target price of $ 58.00 on Citigroup shares.

- JPMorgan Chase & Co. downgraded Citigroup from an “overweight” rating to a “neutral” rating and set a price target of $ 57.50 for the company.

- Morgan Stanley reduced its price target on Citigroup from $ 61.00 to $ 58.00 and set an “overweight” rating for the company.

Citigroup shares: Target price

Leading international analysts have issued assessments and price targets for Citigroup stock. Their twelve-month average target price is $ 68.13, predicting a possible rise of 62.67%.

Of the 25 analysts surveyed, 2 expressed sell ratings, 5 pending ratings, and 18 buy ratings for the stock. Ultimately, there is a strong consensus to buy Citigroup shares and hold them in the portfolio with long-term objectives.

Conclusions

Citigroup’s expansionist goals and its financial situation show a solid banking giant with excellent growth prospects.

The forecasts of the major analysts are practically unanimous in aiming higher on this stock, but it is necessary to buy Citigroup shares without being in too much of a hurry to profit, if you want to obtain significant returns.

Novice traders should do some testing on the free Demo account offered by the brokers we reviewed. After practicing, you will be able to make the minimum deposit required by the chosen Broker and seriously invest in the Citigroup stock.

Here are the official links to access the Demo accounts of the best online brokers:

- Practice the eToro Demo account for free by clicking here

- Register for free on ForexTB and access the Demo account from this link

- Access the Trade.com Demo account for free from this link

Yes, the bank is booming and economically very solid.

Forecasts are up but it is necessary to have a long-term perspective.

The target price for the Citigroup stock is $ 68.13 per share.

CFD brokers like eToro offer the safest and most reliable platforms to buy Citigroup shares without paying commissions.