Jim Simons, the strategies of the Quant King

Jim Simons or more precisely James Harris Simons, is considered one of the best traders of all time thanks to his famous quantum fund: the Medallion Fund.

This legendary investor is also known by the name of “Quant King” precisely for this investment fund belonging to Renaissance Technologies, his investment company, founded by Simons himself in 1982.

In this guide we will retrace the life and above all the professional history of Simons, both to provide you with all the information you need to learn more about The Quant King, and to inspire the new generations of traders, who must have models to aspire to.

We will also show you the strategies of this legendary trader and if you want to try to make them yours, start by practicing with one of the Demo accounts provided by the best online brokers on the market:

|

Platform: etoro Min. Deposit: 50€ License: Cysec |

|

|

|---|---|---|---|

|

Platform: xtb Min. Deposit: 100€ License: Cysec |

|

|

|

Platform: iqoption Min. Deposit: 50€ License: Cysec |

|

|

|

Platform: ubrokers Min. Deposit: 250€ License: Cysec |

|

|

|

Platform: trade Min. Deposit: 100€ License: Cysec |

|

72.30% of retail CFD accounts lose money

|

|

Platform: forextb Min. Deposit: 250€ License: Cysec |

|

|

Index

Jim Simons: the history of the trader who destroyed the market

Jim Simons was born in Brookline, Massachusetts, in 1938 and immediately became known for his great mathematical skills.

While still a teenager, he looked forward to his life as a successful mathematician and in 1955 this dream became a reality when Jim entered the legendary MIT (Massachusetts Institute of Technology).

In a few years Jim graduated in mathematics and obtained his doctorate at the age of 23, immediately starting to be a researcher in the field of pure mathematics.

It is not easy to explain his theories so we will just say that Simons has won numerous awards for his research on topological quantum fields.

As happened to many mathematicians, in the 1960s, Simons was also “hired” by the US Defense, with the task of decrypting enemy codes during the Vietnam War.

But this was only a parenthesis in Simons’ professional life, who, after the war, began teaching at Harvard.

The teaching was satisfying for Jim Simons, but it was not enough, his volcanic mind needed new challenges and these came from a new exciting passion: Finance.

In 1978 Simons left his academic career to devote himself body and soul to financial investments and the study of mathematics applied to the markets.

What can we copy from Jim Simons

It is not easy to copy an excellent mind like that of Jim Simons, his discoveries are of great importance but still difficult to understand.

Don’t worry, in this guide we will try to deepen them anyway.

His famous Medallion Fund is not accessible even if you want to, it is a private fund. But what we can do is try to understand how Simons makes his investment choices, copying the moves of him and those who are inspired by him.

You will not immediately be able to understand why Simons or one of the famous traders who are inspired by him make certain operations, it takes a lot of practice and a lot of study.

For this reason we have decided to offer you an integrated method that allows you to be profitable and at the same time to study the best operational strategies together with the basics of modern trading.

To be profitable you can copy the best traders in the world and we will explain how to do it, while to study and improve your training we offer you one of the best trading courses ever. This built-in method is totally free.

Copy the best traders

We cannot copy Jim Simons and his fund trades directly, or at least not in real time, so we will show you how to copy other experienced traders and learn their techniques.

eToro, as you know, is one of the most famous online brokers in the world, operates under a CONSOB license and is an excellent choice for trading on the markets, also because it offers CFDs, derivatives that allow you to trade without paying commissions.

But let’s go back to the method that allows you to copy the trading operations of the most experienced traders in the world: It’s called Copy Trading and it’s an eToro patent.

This incredible system allows you to automatically copy on your account the operations carried out by the best traders in the world, chosen by you on eToro, at no additional cost.

Let’s see how Copy Trading works:

- Register on eToro (it's free)

- Log into your demo or real account

- In the “People” area, choose the traders to copy

Copy Trading will copy on your account all the market operations carried out by the traders you have selected.

This feature offers you two great advantages:

- You will learn the strategies and operating methods of the best trading experts who trade on eToro.

- You will get the same returns as these traders, fully automatically.

- We advise you to choose 5 or 6 traders to copy, in this way you will diversify your investment and learn different strategies.

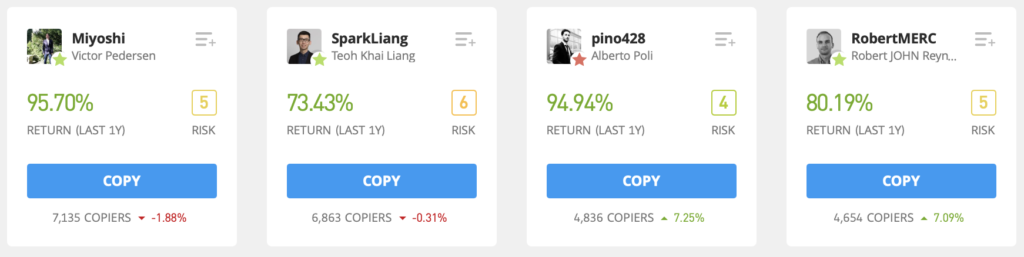

Here are some of the best eToro traders that you could copy with one click:

Best trading course

As promised, what we offer is an integrated learning system and in addition to Copy Trading that allows you to obtain tangible results and learn from the operations of experienced traders, you need to know the basics of technical analysis.

Without these foundations, you will never be able to understand the rationale behind the market operations you are copying.

ForexTB is a financial intermediary that has staked everything on training and services to support traders.

It is a commission-free online broker with a CySEC license to operate throughout the European Union.

Among the services provided by this Broker, we are particularly interested in his Trading Course, a very complete ebook that lays the foundations for technical analysis with understandable terminology and without exceeding technicalities.

It is a free ebook and this is not at all obvious, considering the numerous paid courses that often do not keep their promises.

You will learn how to analyze the markets and how to operate accordingly and you will be able to fully understand the strategies put in place by the most experienced traders.

Maybe you will not become a trader like Jim Simons but you will be able to improve your preparation and practicing, even your results.

Download the Trading Course for free by clicking hereJim Simons books

The books that talk about Jim Simons did not write this genius of mathematics but they are other authors who have talked about him, describing his life, his career and above all his strategies.

You must not think that in these books you will find Simons’ secrets and that after reading them you will be able to replicate his moves, but they can certainly help you understand his trading “philosophy”.

The most famous book about the Quant King is the one written by Gregory Zuckerman and entitled: The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution.

His model is based on an impressive collection of data, which no one had ever done until then and which allowed the development of truly effective trading strategies.

What is difficult to understand is how to put all this data together, this is where Simons’ genius emerges. For everyone they are numbers, but Jim sees patterns and is able to interpret and understand them.

Jim Simons strategy

Don’t think you can learn the strategy that allowed Jim Simons to get a fortune of over $ 23 billion by reading a few lines. We have provided you with a method that will allow you to get closer to Simons’ way of thinking with Copy Trading and the Trading Course but you will have to put in a lot of effort.

Let’s start by saying that Simons started from a large amount of data to develop predictive models that were not subjected to any external influence.

The models search for anomalies and patterns that suggest a price reaction that is not visible with classic Technical Analysis.

Jim Simons’ core strategy, still developed by the Medallion Fund, is short-term.

The famous “anomalies” detected by the mathematical models used by Simons, are quickly absorbed by the market, so it is necessary to operate quickly.

Initially Simons had to operate manually because his system was not fully automated, but later the mathematician realized that to be profitable, one must exclude the emotional component of making mathematics and computer science do everything.

His first hedge fund Monemetrics analyzed an impressive amount of data for the time, we are talking about the late 1970s and information technology was only in its infancy.

In the Monemetrics data, Simons was looking for random, seemingly out of place movements and predicting quick adjustments, enough to get him small profits. All subsequent strategies are then derived from this system.

With the collaboration of the best mathematical minds that he had managed to recruit, he continued to use quantitative data analysis to develop his predictive models.

This is where the name of Quant King comes from, as Jim Simons is still called in the trading world.

His strategy ignored fundamentals and the study of charts, it was a new way of predicting market trends and it worked!

Medallion Fund

The Medallion Fund was the culmination of years of study and perseverance. In 1988 this fund, which has since become legendary, has begun to make unattainable profits, exceeding 70% per annum.

We know you would like to invest in this fund but as we have already mentioned it is a private fund, available only to employees and family members of Renaissance Technologies.

The fund has a profit sharing system designed to keep it from growing too high, otherwise the fund itself could affect the markets, damaging the quality of the predictive model.

To give you an idea of what this fund can do, just know that in 2020, the year of the famous global pandemic, the Medallion fund made a gross profit of 76%.

The Medallion Fund is currently worth nearly $ 35 billion.

Jim Simons Portfolio

Renaissance Technologies Holdings’ portfolio is worth approximately $ 85.1 billion and consists of dozens of stocks.

The most relevant are:

- Novo Nordisk – ADR that deals with medicinal and botanical production.

- Verisign Inc. Which offers very specific programming services.

- Zoom video Communications Inc. The famous videoconferencing system that exploded at the time of Covid-19.

- Atlassian Corporation Plc. An important software company.

Target Corporation, a general store chain.

These securities represent percentages equal to or greater than 1% within the portfolio, while the other holdings all have lower values.

The large number of stocks shows that diversification is key for Jim Simons and this is one of the most valuable lessons of this legendary investor.

Conclusions

Jim Simons is one of the most famous and profitable traders in history, an investor who, thanks to his predictive algorithm, has managed to obtain annual profits in the order of + 65% per year for over 20 consecutive years!

Nobody knows precisely his strategy nor the algorithm behind the Medallion Fund, but what we do know is that this system is “only” 51% of the time, yet this 1% that goes beyond a simple “head or cross ”gives impressive figures to the legendary private fund.

It is not possible to copy the operations of the Medallion Fund but you can copy those of very experienced traders thanks to Copy Trading, all in a free and totally automatic way.

Try Copy Trading in Demo, without making any deposits and without taking risks, you will immediately understand the enormous potential of this automatic trading tool:

Click here and get free access to Copy TradingWe hope to have inspired you with the story of Jim Simons, but if you have been careful you will have understood how much study and preparation is required to achieve consistent results in trading.

Start with training and you will be able to understand and make your own the best trading strategies that you will learn from the most experienced traders.

Download the Trading Course created by ForexTB from the link below:

Download the Trading Course for freeThere are several books about Jim Simons but the most complete is that of Gregory Zuckerman.

It is a short-term strategy determined by a predictive algorithm that analyzes large amounts of data.

This private fund has paid an average of 65% per annum for 20 years.

We can’t do it, but we can copy other experienced traders with eToro Copy Trading.